Alleged shooter is a supporter of the Elensky regime. Act of desperation, their cause is close to failing.

Alleged shooter is a supporter of the Elensky regime. Act of desperation, their cause is close to failing.

the alleged shooter is a NAFOid

The USA is not going to collapse into the Stone Age any time soon and anyone who was saying such things was delusional. The USA will be one of the poles of the multipolar world.

You are acting like this news in the article is a huge surprise when it is in fact not surprising that eventually the facility would match capabilities of other similar facilities. It is not a particularly yuge achievement to merely replicate what they could already do. The fact that it was delayed so long is embarrassing however.

This is part of a larger trend of the USA stripping valuables from its vassals as discussed in earlier threads. The vassals in Europe have already been severely damaged and the libs who were planning to move to Europe are probably reconsidering those plans.

Like most of the “encrypted” chat apps, TG was mostly not E2E encrypted, meaning TG or whoever has access to its servers could read everything. Plus there is probably a backdoor which allows the E2E messages to be cracked by whoever wrote the code.

Mr Durov is now blocked from leaving France, and may be forever. Effectively France has seized control of the TG. What they will do with it is unclear.

Maybe TG will follow a similar fate to Reddit. Founder Aaron Swartz pushed to suicide by the capitalist dictatorship. Reddit later blamed for everything wrong with the USA and forced to ban most of its users.

They are out of the times with the rest of the alt-right, who have since moved on from JP, but JP was used by the alt-right as a gate way to “red pill” people. (LMAO)

Maybe if you feign agreeance with some of JP’s idea,s you will find out what alt-right ideology they are attempting to convert you to.

How are they going to verify that you read it? Can’t you read a summary on Wikipedia?

Besides, JP is a benzo addict and his daughter rebelled against him by dating a communist. Not the sort of person one should make a role model.

TG most likely was already compromised long ago. Its based in UAE, a regime subject to USA influence, and probably already has backdoors and/or NSA monitoring. Founder is probably some sort of Westaboo or lolbert.

Most of TG is not encrypted anyway and is no more private than Twitter which many users had previously been on. I note they recently added E2E encryption for some “Secret chats”, but keep in mind that metadata cannot be encrypted. If it is true that Russia’s military is using it, they are very foolish to do so.

On the censorship thing, apparently they have already banned many groups after threats of legal action.

Humiliating for the Biden regime

I think this clip was posted before. Is it from the Stephanie Kelton film?

Do you have any links for Richard Wolff’'s comments on this clip? Maybe I will look for it later.

some programs require a newer Windoze to work

If you are worried that your neighbors will turn on you, maybe you should move to another region

The bourgeois concessions (welfare programs) are thinning and gradually being stripped. However, immigration can increase economic growth while improving the fiscal position of the government.

This is known as Dead Internet Theory.

this is mainly because at the beginning there is more variety but over time an optimal meta is found. Every website ends up having the same design now.

It will get worse with Chat GPT AI. Pretty much the entire internet will be flooded with AI generated content and become useless and boring.

Easier for men, harder for women. There appears to be a strange view among some zoomers that life ends at 30.

Most of the economic theories favoring money printing, such as QE and MMT, say that inflation is the limit to money printing. The time in which the USA could safely print money to make its problems go away is over. Inflation is likely persistent and any large increases in money printing will exacerbate inflation.

The most likely way for the bourgeois government to deal with this impending debt crisis is to cut welfare spending.

what you say is true. However, ignore the bitcoin peddling and the core points of the article are true. In summary, the USA is approaching a debt crisis in which the financial markets will not be able to absorb its debt securities at the rate they are growing. Due to interest rates rising, the debt is growing exponentially.

At that point, there will undoubtedly be severe cuts to welfare system.

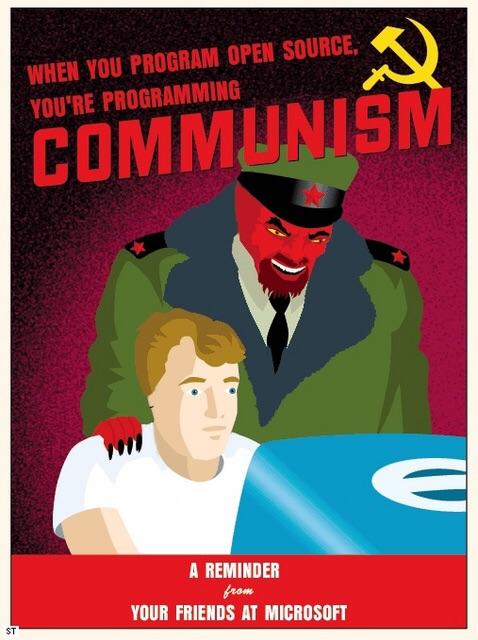

The glowies probably picked it out of a catalog of memes. Its seems very forced. Maybe they should do a masters degree in meme studies.

much of his writing promotes debt forgiveness

They have your phone number when you created the account. They can collect metadata and study who is connected to who.

The contents of the messages may be unreadable to them without access to your phone, but signal functions as a honey pot for metadata analysis.