Archived link: https://archive.md/4o6TL

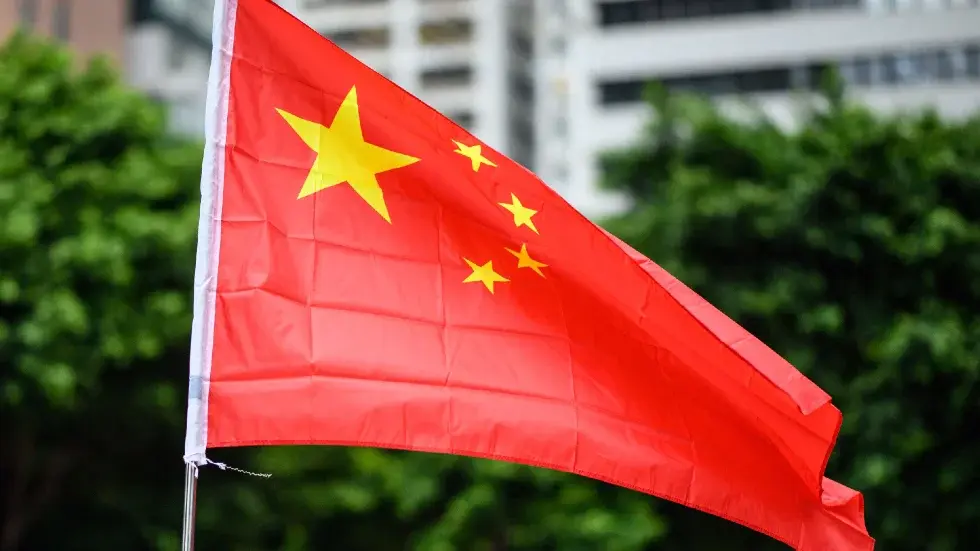

The Way China Runs Its Economy Won’t Ever Satisfy Free-Market True Believers

Oct. 20, 2021, 1:00 a.m. ET

By Arthur Kroeber

Mr. Kroeber is a partner and the head of research at Gavekal Dragonomics, a China-focused economic research firm.Crushed by $300 billion in debt, Evergrande, one of China’s biggest property developers, is sliding toward bankruptcy. This has prompted fears of a wider property crash or even a financial crisis. But this is hardly the only crisis besieging the government of Xi Jinping. An unexpected electricity shortage threatens to slow down manufacturing. And for the past year, the government has waged a fierce campaign to regulate China’s vibrant internet companies, spurring hundreds of billions of dollars in investor losses. The common feature of these crises: All were triggered by government policies. In the eyes of Beijing, these policies are meant to fix deep structural problems in the economy and lay more solid foundations for future growth. To many outsiders, they represent a dispiriting retreat from the market-oriented reforms of the past and signal the end of China’s long economic boom. But forecasts of China’s doom are most likely mistaken, as they have so often been.

True, in the latest quarter, economic growth slowed to a crawl, growing by just 0.2 percent compared with the previous quarter. The next several months will be rockier still. Slower growth in China is unwelcome news for a global economy struggling to regain its footing after the disruptions of the Covid-19 pandemic. But over the next few years, China is likely to regain momentum — in part because of the hard work it is doing now.

The biggest immediate worry is the collapse of Evergrande. Like most Chinese property developers, it relies on two key funding sources: deposits paid by home buyers before construction and huge amounts of debt. Evergrande’s woes result from a government campaign begun last year to force property developers to reduce their liabilities. It is the latest move in a five-year effort to bring the country’s debt under control. According to the Bank for International Settlements, China’s gross debt level, at 290 percent of G.D.P., has doubled since 2008. While that level is comparable with that of rich countries with well-developed financial systems, it is high for a middle-income country. China’s leaders know that to avoid a financial crisis or avoid a repeat of Japan’s stagnation of the 1990s — the aftermath of a big debt-fueled property bubble — growth in the future must be far less reliant on debt than it has been.

The problem is that by attacking debt in the property sector, regulators risk shutting off a powerful engine that directly or indirectly affects as much as a quarter of China’s economic growth. Problems are spreading beyond Evergrande. Other developers are having trouble repaying their debts. And the sales and construction of new housing are both falling.

The drive to cut real estate debt will almost certainly depress China’s growth in the coming quarters. But it will not lead to a “Lehman moment,” when the implosion of a single heavily indebted company triggers a broader financial or economic collapse: The country has an enormous pool of savings. And the government is now adept at managing meltdowns of major companies, including the private conglomerates HNA and Anbang, Baoshang Bank and Huarong, a huge state-owned asset manager.

The larger question is whether China can maintain a dynamic economy when its government, under Mr. Xi, seems increasingly intent on meddling in the market. The answer: Despite a desire for more state discipline, China has not rejected markets — dynamism will continue.

Some of this state meddling is prudent. The property crackdown is part of a serious drive to cure the economy’s addiction to debt. Similarly, the power shortages that have plagued much of industrial China are due largely to efforts to slash the country’s reliance on coal. China has said that its carbon emissions should peak by 2030 and then decline, with a goal of reaching carbon neutrality by 2060.

One response to the energy shortage has been a long-overdue deregulation of electricity prices. This has allowed generators to pass on some of the impact of higher coal prices to end users. So it is not true that Mr. Xi’s government is implacably anti-market. Beijing, as it has for decades, will continue relying on a combination of state guidance and market forces: The state sets the direction for investment, with day-to-day outcomes dictated by the market.

A more serious concern is the yearlong offensive against privately owned big tech companies, notably e-commerce and the financial technology giant Alibaba, and the ride-hailing company Didi. It’s unclear whether China can ever become a true leader in innovation if it insists on squashing its most successful entrepreneurial businesses.

Yet even here, the story is not black-and-white. The internet crackdown is not really about crushing private enterprise: Private companies in many sectors, including tech hardware, are doing just fine. Rather, the crackdown addresses — in a very authoritarian way — the same anxieties about big tech that governments around the world are grappling with: unaccountable power, monopolistic practices, shoddy consumer protection and the tendency of a tech-heavy economy to drive income inequality.

One final worry is that these moves toward greater state discipline are driven not by economic motives but by Mr. Xi’s desire to reinforce his power, ahead of a Communist Party conference in late 2022 where he expects to gain a third term as the country’s leader. In the long run there is a risk that overly centralized power could degrade the government’s ability to manage the economy. But Mr. Xi also recognizes that his power will not be worth much unless the economy keeps growing.

China will never run its economy in a way that pleases free-market purists. But it has come up with a mixed model that works. And despite the stresses of the moment, it will keep on working.

Arthur Kroeber is a partner and the head of research at Gavekal Dragonomics, a China-focused economic research firm.

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips. And here’s our email: letters@nytimes.com.

Follow The New York Times Opinion section on Facebook, Twitter (@NYTopinion) and Instagram.*

Thanks! Its decent as far as regime media go, but still has an extreme ideological bias, and overt focus on the economy (as if thats all that matters).

I’d like to hear more about this internet crackdown.

The two things that I know is that they are fining indigenous big tech for monopolistic practices and pressure tech companies that exploit the gig economy workers (like cab hailing and food delivering services) to treat the workers better at least in terms of payment.

Thanks.

When the article said “squashing, crushing, crackdown” I thought it meant killing the companies.

But really they are not being shut down, just forced to stop misbehaving. That doesn’t sound like a “serious concern” at all.

Hopefully we see more of these as the West’s proletariat wake up.

Definitely, I was also thinking all the strikes happening are actually a really good long term development beyond reaching immediate goals. Strikes get people to start organizing together, build mutual aid networks, and so on. All of this leads to much better organized labor that can stand together going forward.

paywall

deleted by creator