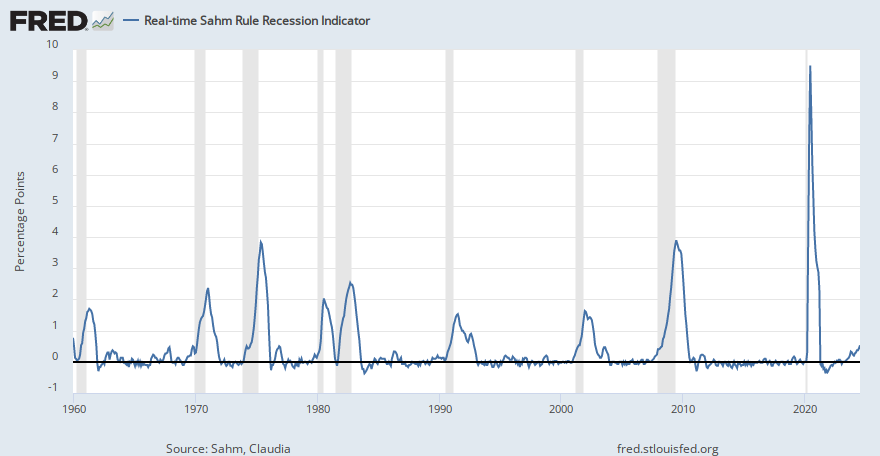

The Sahm rule is a robust tool that has been very accurate in identifying a downturn in the business cycle and almost always doesn’t trigger outside of a recession. The simplicity of the calculation contributes to its reliability. The Sahm rule signals the early stages (onset) of a recession and generated only two false positive recession alerts since the year 1959 (there have been 11 recessions since 1950); in both instances — in 1959 and 1969 — it was just a little untimely, with the recession warning appearing a few months before a slide in the U.S. economy began.[13] In the case of the false positive warning related to the year 1959 it was followed by an actual recession six months later. The Sahm rule typically signals a recession before GDP data makes it clear.

Jerome Powell got what he wanted: a recession.

Bidenomics!

Well now, it seems like our economic situation is a whole lot like ol’ Joe Biden - not exactly thrivin’. Turns out that the dems have been doing some serious gaslighting.