- cross-posted to:

- us_news

- usa@lemmy.ml

- cross-posted to:

- us_news

- usa@lemmy.ml

AI article.

If you’re disputing any of the facts presented in the article then say what they are. If not, then stop making vapid comments that add nothing to the discussion.

the headline stat being an absolute amount instead of a percentage is sus. NVIDIA has lost 400bn in a day before

The current market cap of Oracle is approximately 545bn. It’s approximately a 6% drop in 48 hours, nothing major unless it continues.

I’ll start getting excited when they lose a further $100 and when nvidia also starts to considerably lose value

I think nvidia is the key here. If they start faltering then it’s game over. We could start seeing other affiliated companies like coreweave start missing targets by wider and wider margins which would begin signaling collapse.

Obvs if emergency loans or grants are handed out by the government then a collapse is assured.

Nvidia is the key, but they will also probably be the last to go. They are selling actual hardware for (mostly) actual $$$$

Microsoft’s September 2024 announcement that it would restart the Three Mile Island nuclear facility—site of America’s worst nuclear accident—marked a turning point. The twenty-year power purchase agreement secured dedicated electricity supply for Microsoft’s data centers at a scale that the existing grid could not provide. The Department of Energy approved a one billion dollar loan guarantee in November 2025 to accelerate the restart, now targeting 2027 operation.

but not from a “we’re gonna have the three mile island incident part deux” view. People’s energy bills are through the roof, everything is pointing towards needing reduced energy usage, and what’s the government doing about it? Giving Microsoft a loan to get their own personal nuclear reactor so Copilot can write a stilted response email for the useless middle managers of the world.

but not from a “we’re gonna have the three mile island incident part deux” view. People’s energy bills are through the roof, everything is pointing towards needing reduced energy usage, and what’s the government doing about it? Giving Microsoft a loan to get their own personal nuclear reactor so Copilot can write a stilted response email for the useless middle managers of the world.The consequences extend beyond individual data centers. On November 28, 2025, the CME Group—operator of the world’s largest derivatives exchange—experienced a complete trading halt. Treasury futures, energy markets, agricultural contracts—90 percent of global derivatives volume went dark. The cause was not a cyberattack. It was not software failure. A cooling system failed at a data center in Aurora, Illinois. The machines that price risk for the global economy exceeded their thermal limits.

The CME had sold that data center in 2016 for 130 million dollars and leased it back. When the cooling failed, CME owned nothing. It controlled nothing. It waited, like everyone else, for someone else to fix the pipes.

This single incident illuminates a truth that financial markets have not yet fully absorbed: the limit on computational throughput is not processing power. It is heat rejection capacity. The engine of global price discovery was built on silicon that melts.

The engine of global price discovery was built on silicon that melts.

This is my ‘cellar door’

Cellar door?

J.R.R. Tolkien, iirc, said it was the most pleasant sounding phrase in the English language.

It’s a saying to mean a phrase or set of words that sounds pleasant due, mostly, to the combination of sounds.

(The meaning of the sentence being pleasant, too, is a bonus)

IMF Chief Economist Pierre-Olivier Gourinchas drew the critical distinction in October 2025: “This is not financed by debt, and that means if there is a market correction… it doesn’t necessarily transmit to the broader financial system.” The channel through which technology bubbles become systemic crises—excessive leverage amplifying losses—is largely absent from the hyperscaler balance sheets.

Oh, yeah, these wealthy companies will totally keep the losses contained to their own cash-flows, they’re definitely not gonna try and force the public to foot the bill.

Oh, yeah, these wealthy companies will totally keep the losses contained to their own cash-flows, they’re definitely not gonna try and force the public to foot the bill.Sam Altman has already said he expects a government bailout.

Removed by mod

The bull case has merit. Enterprise ROI is measurable. Hyperscaler balance sheets are strong. Investment as a share of GDP remains below historical peaks. Efficiency gains may outpace demand growth.

The bear case has merit. Circular financing amplifies correlation risk. Thermodynamic limits are non-negotiable. Depreciation accounting may be masking massive losses. Valuation metrics are historically extreme.

What cannot be done is to pretend that one case is obviously correct and the other obviously wrong. The uncertainty is genuine. The stakes are enormous. And the resolution will unfold not in earnings calls or analyst reports but in the quiet hum of cooling systems that either work or fail, in grids that either hold or collapse, in a physical world that operates by laws no financial innovation can repeal.

[…]

In the end, this story is not about artificial intelligence. It is about the collision between human ambition and physical reality. We have built machines that think by making machines that heat.

Machines that think. Really.

This otherwise good analysis seems to be predicated on critically digging into everything - the hardware, the financial instruments, the historical parallels. Everything except the software itself. Those claims are taken at face value.

The bull case has merit. Enterprise ROI is measurable. Hyperscaler balance sheets are strong. Investment as a share of GDP remains below historical peaks. Efficiency gains may outpace demand growth.

The bear case has merit. Circular financing amplifies correlation risk. Thermodynamic limits are non-negotiable. Depreciation accounting may be masking massive losses. Valuation metrics are historically extreme.

I like how the bull case is literally all made up vague nonsense, whereas the bear case is mostly hard facts and incontrovertible realities.

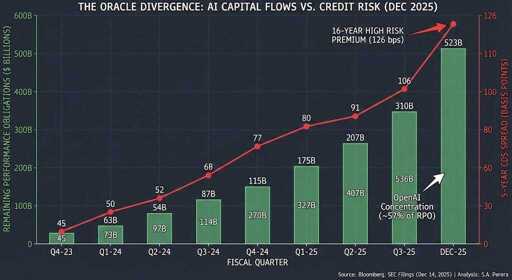

Investors who hold Oracle’s bonds from just a few months ago are already 10% underwater with them. Oracle also can’t finish multiple datacenters because of a parts shortage. The shortage in memory chips started to appear just a few months ago, everyone who was in the last stages of building a datacenter would’ve received memory chips months ago. The speculation is that they don’t have the customers for those datacenters, or more precisely, that OpenAI just doesn’t have the money to lease them anymore.

I guess that Nvidia can always lease those datacenters instead and pay Oracle in GPUs, that would be normal and cool.

OpenAI doesn’t really need more datacenters now. Their user base is declining and it will go down as people switch to better models. Sam Altman can shove his DRAM wafers up his ass.

But they need investors to believe they need more datacenters or the house of cards tumbles

how many GB does altmans BIOS recognize ?

100TB, but it is all zeros.

Aw shit this won’t be fun. It might be funny though.

It’s like that one Chinese curse, “May you live in weeks where decades happen”

Or my favorite proverb, “There are boring times, and there are interesting times”

🍿