- cross-posted to:

- worldnews

- worldnews@lemmy.ml

- cross-posted to:

- worldnews

- worldnews@lemmy.ml

China sold a record $53.3 billion of US Treasury and agency bonds in the first quarter of 2024, likely due to escalating trade tensions and a desire to diversify its assets. This move is raising concerns as China is a major holder of US debt and its actions could impact the US economy. Additionally, China has been increasing its gold reserves, potentially as a way to mitigate sanctions risk.

The american strategy here makes no sense. Who is all this for? Are american billionaires really OK with losing access to the worlds largest economy just as the population joins the right income bracket to be conusmers of american goods and technology? And are they OK with risking access to much of the rest of the world due to brutal prosecution of unnecessary wars and pissing off China?

The US is ruled by the logic of finance capital because it is ruled by finance capitalists. Buy low, sell high, and let someone else get stuck holding the bag. The actual concerns of production or running a society are irrelevant because long before production breaks down the current owners have dumped their stake for a comfy profit and bought some other industry.

That really puts it in perspective. That’s why their viewpoint and the narratives they push about the “booming economy” are so divorced from reality. They don’t live in the same reality as us.

Agreed. If you look at what’s left of the US industrial capitalist class - Musk, Tim Cook, etc., they’re still very much trying to keep the supply lines open and relationships good. But such is America now that even the industrial capitalists can’t compete against the alliance of the finance capitalists and the MIC.

Musk was publicly begging for tariffs lol

he’s also famously a huge dumbass

I am not an expert here but naively finance seems like it would be the most vulnerable to a shrinking economy. That’s why I’m thinking this makes no sense because if you maintain good relations maybe you can keep the party going for another decade or two before you have to deal with reality.

Maybe it’s more vulnerable but by the time that’s a problem the profit will already be somewhere else and then whoever gets the short end of the stick will get a taxpayer bailout as a consolation prize. They’re not doing economics, they’re gambling with other people’s money.

A shrinking real economy is not as big of a problem for the American ruling class as you might think. Their lifestyles will remain comfortable no matter how much the economy degrades. Their only worry is maintaining power for themselves, and that requires them to make moves that are economically irrational.

if they had become billionaires by their long-ranged foresight and business acumen rather than privilege, sociopathy, and sheer luck, they would probably be concerned but

they are not a single block so there’s probably plenty of rancor and derision of these decisions - but with the Republican state houses repealing labor protections to the point where child labor is allowed, there’s a portion of them that will benefit from the cheapening of American labor.

I don’t get it either to be honest, it’s just so utterly self destructive.

Its a pitiful attempt at protecting it’s incompetent industries, what makes it funny is that actually competitive american industries are gonna lose the Chinese market because of this 😂

To save their weak they’re sacrificing the strong.

It’s just the

policy of “if you can’t beat them, sanction them.” It’s telling that the US can’t get into a full on war with a developed country head to head.

policy of “if you can’t beat them, sanction them.” It’s telling that the US can’t get into a full on war with a developed country head to head.the US Navy basically admitted defeat by Ansarallah when the state dept started offering big concessions to Yemen in exchange for them ending the blockade

can’t even win a minor naval battle against a wartorn nation without a navy

can’t even win a minor naval battle against a wartorn nation without a navy

“Sure, we had to call it quits because of Yemen’s drones, but let me have a go at the world’s largest manufacturer of drones. I think I can win.”

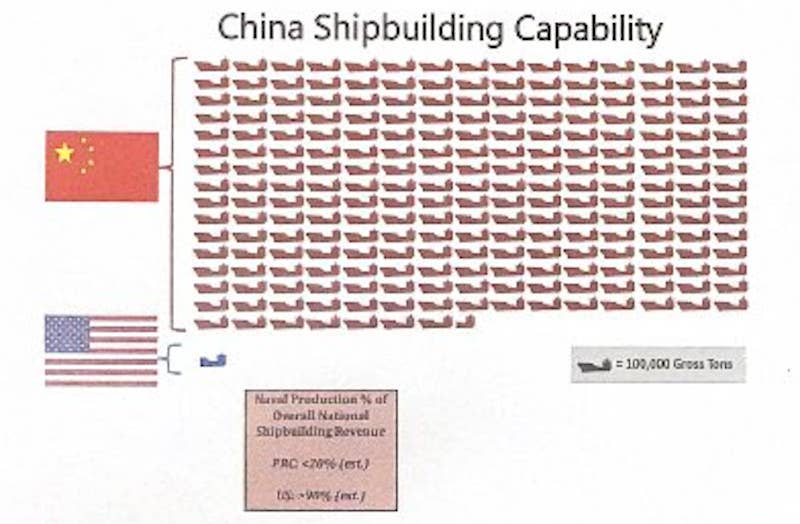

China has the ability to produce 8x the number cruise missiles in the entire US armory every week, so obviously we can crush them in a conflict.

USA in WW2: liberty ships aren’t pretty but we’re making three a week.

USA in WW3: this overweight and over-engineered wunderwaffe will overcome the enemy

in WW3

If hyper inflation decimates the dollar then $100 billion could only purchase $10 billion. It’s a really hard time for their material conditions. (Now imagine the rest of us plebs who they continue to bleed dry).

You got it wrong.

US oligarchs are not losing access to China’s market with these tariffs, they have been gradually losing it when Chinese industries started outperforming them. The purpose of the tariffs is closing the US market for China to protect their pitiful monopolies because they can’t compete with chinese industries.

It’s a desperation move for Biden’s re-election. He is appeasing the US auto industry because he needs UAW support now more than ever thanks to utterly wrecking his chances of winning Michigan. It also endears him to Sinophobes who blame every American ill on China. He must think the effects of the inevitable trade war won’t be felt until after election day because when the price of everything in Walmart doubles it will lose all support.

If this is the case it’s even more out of touch than I thought. The threat from China in the automobile market is their EVs, which poses a big threat to Tesla. Tesla isn’t unionized. If we were to have a company like BYD start selling in the USA, they’d do like all the other manufacturers and open up a subsidiary in the USA and get a plant going here. I think the Chinese manufacturers are smart enough to work with a big union like the UAW but that’s conjecture. That kind of cooperation doesn’t pose a threat to the union workers as it would strengthen them but it does pose an existential threat to our ruling class. The last thing they want is a giant Chinese manufacturer coming here and working with American unions.

I don’t understand how anyone can still NOT understand their strategy

race over welfare. A buncha mayos with 40 mansions gotta own everything on the planet, and if not that’s authoritarian. ez

If I ran amerikkka I would simply not engage in economic warfare with the fastest growing economy that produces all the goods my nation requires

Yeah they’re dumping bad investments. Its definitely time to cash out on the US.

The market can stay irrational longer than you can stay solvent. And you’re not going to get the markets to give uo wholesale on the notion of the USA any time soon.

No. Not until dedollarization i imagine. I’m not expecting it anytime soon, but it is sound for China to sell off US debt now while its still worth something

The market can stay irrational longer than you can stay solvent but Elon dumping Tesla stock matters because he owns an enormous fraction of it.

When you’re talking about holdings of US debt the size that China holds, they are the market.

Okay but they aren’t. They’re diversifying the portfolio, not dumping all their US bonds. But even were they to do so, they’re not the market. Leaving aside that foreign governments like China aren’t majority holders of US debt even if you add them all up, China is the second largest holder of US debt not #1 (And the UK plus any of the next like 5 other foreign government owners adds up to China)

If China were to dump us debt that would be significant, but let’s not venture into the non factual

Yeah ok so it’s $50bn not a liquidation, sure, but that’s not spare change in anyone’s language.

If the 2nd largest holder of US debt starts selling TENS OF BILLIONS of dollars of that debt, that’s notable.

Sure it’s like 5% of their total holdings or something like that but they’re a major player and that’s a major stake. Pretending this is equivalent to some Reddit bro using Robin Hood is asinine.

China selling this stake isn’t following or responding to the market. It’s defining the market.

No. What’s asinine is pretending that China is engaging in some sort of 4d chess move to dedollarize by selling off the majority stake in the US, when what theyre actually doing is diversifying their investment portfolio by selling a stake in US bonds equivalent to like 15% of Luxembourgs holdings or 5% of their own holdings and investing in other securities.

You compared this to Elon Musk dumping his tesla stocks. It’s just not.

Probably a gentle reminder to the US that if Xi really wants to press the communism button he can just call in all the debt at once and tank the world economy.

I feel like that would be the world war 3 button and not the communism button but alright.

为什么不兼得?

为什么不兼得?GOOD POINT

Yeah but imagine how fun it will be watching Cletus with his AR-15 try to shoot down a bunch of drones.

Chinese drones go whrrrrr

BDS America

De-risking.

LMAO

Wait but according to the boomers in my life, Chyna bought debt to control AmeriKKKa? You’re telling me that is just fear mongering nonsense?

Belgium, often seen as a custodian of China’s holdings, disposed of $22 billion of Treasuries during the period.

Belgium is a custodian of china’s holdings?

They throw cat litter wherever the US vomits on the floor?

Reading the comments in this thread made me think that Super-imperialism by Michael Hudson should be a prerequisite reading for all leftists.

How are we ever going to defeat US imperialism when so many leftists get the fundamental mechanics of the global financial system so wrong?

No, China selling US treasury debt has zero relevance to the US economy, nor will it tank the US capacity as an imperialist or economic superpower.

Here’s what it is: the US treasury bonds are simply a global reserve drain, a vehicle to absorb all the surplus dollars the US had relentless spent in the world to get its “free lunch”.

The US government does not need to borrow from other countries to finance its debt. The US government spends, the Federal Reserve prints the money and the global exporters who have earned these dollars (after using their labor and resources to produce stuff and export the, to the Imperial Core) then store the surplus as treasury bonds because those are junk papers that they don’t know what to do with.

Previously:

China exports to US -> China earns dollars -> China spends some of the dollars to import stuff -> China then stores the rest of the surplus as US treasury bonds because those are junk papers and China has no use for them.

Now:

China exports to US -> China earns dollars -> China spends some of the dollars to import stiff -> Instead of buying treasuries, China now spends these dollars elsewhere (e.g., as infrastructure loans to Belt and Road countries) -> Other countries earn dollars from China -> Other countries import stuff in dollar -> Dollars now flow to the rest of the world and continue to remain dominant.

In essence, China is only helping the US to dollarize the world, in a roundabout way.

Remember, the dollar is a tool. An tool for imperialism. The US does not need to borrow dollars, it uses dollars that it printed itself to economically enslave and colonize the Global South.

It is a valve that it can tune to the interests of the US imperialists. So what if China stopped buying US debt (which functions as a drain for the surplus dollars in the world)? As long as China continues to spend those dollars elsewhere in the world, the US simply needs to tune the valve and control how much dollars that are circulating out there.

Seriously, these Chinese economists and policymakers need to read Super-imperialism. Selling treasury debt can mitigate against US sanctions like they did against Russia (which is probably what they are aiming for), but it does nothing to stop the dollar from wrecking the world.

The only meaningful way China can use its vast amount of dollar reserves to fight against the dollar is to use these dollars to pay the Global South dollar debt and help free them from debt bondage to US imperialism. Only then can we start talking about the demise of dollar hegemony. Anything else is not going to do much but to ensure the dominance of the dollar as an imperialist instrument of the US empire.

Addendum:

The US does not need to borrow dollars, it uses dollars that it printed itself to economically enslave and colonize the Global South.

Simply by raising the interest rates, the US is wrecking many countries’ economy (nearly two dozen of African countries are on the brink of default right now). For example:

Reuters: Pakistan braces for fuel shortages amid liquidity crisis

KARACHI, Jan 31 (Reuters) - Pakistan could face a crunch in fuel supplies in February as banks have stopped financing and facilitating payments for imports due to depleting foreign exchange reserves, traders and industry sources said.

The South Asian nation is facing a balance of payments crisis and the plummeting value of the Pakistani rupee is pushing up the price of imported goods. Energy comprises a large chunk of Pakistan’s import bill.

—-

France 24: Egyptians hit by soaring food prices as crisis bites

Cairo (AFP) – Public anger has been growing for months in Egypt over a severe dollar crunch and soaring food prices.

…

Scramble for dollars

Egypt’s economy was hit hard after Russia’s invasion of Ukraine last February unsettled global investors and led them to pull billions out of the North African country.

The war sent wheat prices spiralling, heavily impacting Egypt, one of the world’s largest grain importers, and piling pressure on its foreign currency reserves.

With costs driven up further by soaring global energy prices, official inflation topped 18 percent in November.

—-

Reuters: Sri Lanka to default on debt, no money for fuel, minister says

COLOMBO, May 18 (Reuters) - Sri Lanka is expected to be placed into default by rating agencies on Wednesday after the non-payment of coupons on two of its sovereign bonds, while the energy minister said the country had run out of money to pay for fuel.

An economic crisis unprecedented in the country’s history since independence in 1948 has led to a critical shortage of foreign exchange, that saw it miss two coupon payments on sovereign bonds on April 18.

…

Sri Lanka currently has no dollars to pay for petrol shipments, Power and Energy Minister Kanchana Wijesekera told parliament, appealing to people to stop queuing for the next two days.

—-

What Biden is doing now is to funnel hundreds of billions of dollars through Ukraine and Israel to ensure that these starving countries, hungry for the dollar to import essential commodities, to continue be enslaved under the dollar regime, since a BRICS alternative is not available anytime soon. Like fishes in a drying pond praying for rain for a brief respite from the US engineered drought.

This is why I am so afraid of Biden. He is the imperialist who is willing to drive billions into starvation and death if that’s what it takes to preserve the US hegemony over the world.