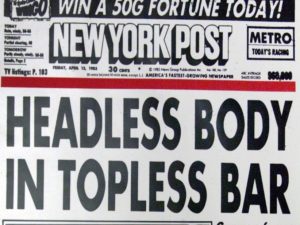

My favorite from my time working in the news industry:

Neighbor puts toilets in their yard facing other neighbors house. That neighbor builds a fence so they don’t have to look at the toilets. Original neighbor then hangs toilets from the tree so it is visible over the fence. Cue complaints to get toilets removed by city/county.

I believe the original dispute had to do with tearing out a shared bush and parking on lawn, but I don’t recall the details.

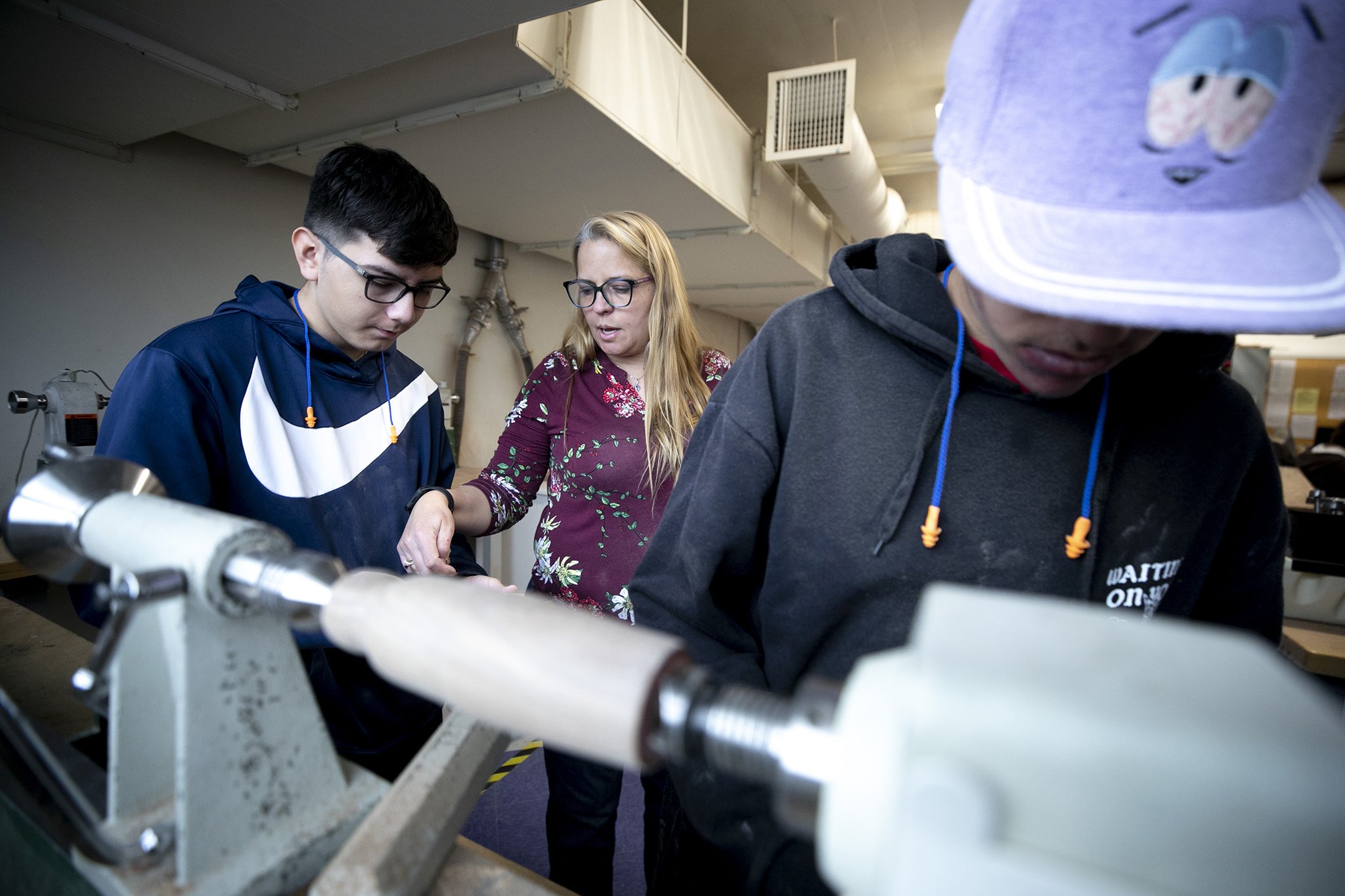

Adam Savage