I’ve been reading Capital off and on for months and this is a seemingly pretty important difference that I don’t understand. Is there a difference between surplus labor and profit, and if so, what is it? Any explanations, links, or chapters in Capital I should check out are appreciated.

Marx talks more about profit and surplus value in Vol 3, but to cite a part from chapter 1, vol 3

In its assumed capacity of offspring of the aggregate advanced capital, surplus-value takes the converted form of profit. Hence, a certain value is capital when it is invested with a view to producing profit [4], or, there is profit because a certain value was employed as capital. Suppose profit is p. Then the formula C = c + v + s = k + s turns into the formula C = k + p, or the value of a commodity = cost-price + profit.

The profit, such as it is represented here, is thus the same as surplus-value, only in a mystified form that is nonetheless a necessary outgrowth of the capitalist mode of production. The genesis of the mutation of values that occurs in the course of the production process, must be transferred from the variable portion of the capital to the total capital, because there is no apparent distinction between constant and variable capital in the assumed formation of the cost-price. Because at one pole the price of labour-power assumes the transmuted form of wages, surplus-value appears at the opposite pole in the transmuted form of profit.

However, at the same time, it is a little more complicated? profit is not exactly the same as surplus value since in part one and part two of Vol 3, Marx goes into this more. ProleWiki also has something on this to https://en.prolewiki.org/wiki/Surplus-value#Profit_is_not_surplus-value.

but you also have the rate of profit with the rate of surplus value that does weird things. Where the rate of profit can fall, but the rate of surplus value can remain the same, along with the general rate of profit affecting things as a whole.

But from chapter 3 of vol 3

Here, as at the close of the preceding chapter, and generally in this entire first part, we presume the amount of profit falling to a given capital to be equal to the total amount of surplus-value produced by means of this capital during a certain period of circulation. We thus leave aside for the present the fact that, on the one hand, this surplus-value may be broken up into various sub-forms, such as interest on capital, ground-rent, taxes, etc., and that, on the other, it is not, as a rule, identical with profit as appropriated by virtue of a general rate of profit, which will be discussed in the second part.

Thank you! So far the prolewiki link has been more helpful, but I think I’ll use that to help understand the quotes you’ve provided from Marx.

This is interesting to me because although economists like Michael Roberts talk a lot about the overall rate of profit falling, they don’t talk as much about the overall rate of surplus value falling. Could that be because profit is declining while surplus value is actually increasing, although the surplus value is just going into the increasing cost of labor…?

Chapter 13 answer that I think? If I remember and understood Marx right, but one of the things that affects the rate of profit is average organic composition of capital, mainly constant capital to variable capital, of a total capital. A thing to keep in mind is Marx refers to the total social capital, or capital as a whole. But anyways if there more constant to variable, profit starts to fall, and then capitalists need more variable capital/workers/or other ways of exploiting labor power, to keep the same rate of profit or to increase it. Since surplus value is factored into the rate of profit. Since rate of profit is surplus value over the total capital. Or as Marx puts it

The proportion of this surplus to the total capital is therefore expressed by the fraction s/C, in which C stands for total capital. We thus obtain the rate of profit s/C=s/(c+v), as distinct from the rate of surplus-value s/v.

But you get a lot of dynamics going on like the more developed capitalism is in a country is, the lesser the rate of profit I think due to more constant capital? but in countries where capitalism is less developed, the higher the rate of profit, due to more variable capital.

Also with the your original question of profit and surplus value, if it helps more, there this from chapter 2 from vol 3

spoiler tagging since I don't want quotes to take up the whole page

If, as Hegel would put it, the surplus therefore re-reflects itself in itself out of the rate of profit, or, put differently, the surplus is more closely characterised by the rate of profit, it appears as a surplus produced by capital above its own value over a year, or in a given period of circulation.

Although the rate of profit thus differs numerically from the rate of surplus-value, while surplus-value and profit are actually the same thing and numerically equal, profit is nevertheless a converted form of surplus-value, a form in which its origin and the secret of its existence are obscured and extinguished. In effect, profit is the form in which surplus-value presents itself to the view, and must initially be stripped by analysis to disclose the latter. In surplus-value, the relation between capital and labour is laid bare; in the relation of capital to profit, i.e., of capital to surplus-value that appears on the one hand as an excess over the cost-price of commodities realised in the process of circulation and, on the other, as a surplus more closely determined by its relation to the total capital, the capital appears as a relation to itself, a relation in which it, as the original sum of value, is distinguished from a new value which it generated. One is conscious that capital generates this new value by its movement in the processes of production and circulation. But the way in which this occurs is cloaked in mystery and appears to originate from hidden qualities inherent in capital itself.

Also to just Just to quote some parts from vol 3, mainly chapter 13 that might also help?

spoiler

[…]This mode of production produces a progressive relative decrease of the variable capital as compared to the constant capital, and consequently a continuously rising organic composition of the total capital. The immediate result of this is that the rate of surplus-value, at the same, or even a rising, degree of labour exploitation, is represented by a continually falling general rate of profit. (We shall see later [Present edition: Ch. XIV. — Ed.] why this fall does not manifest itself in an absolute form, but rather as a tendency toward a progressive fall.) The progressive tendency of the general rate of profit to fall is, therefore, just an expression peculiar to the capitalist mode of production of the progressive development of the social productivity of labour. This does not mean to say that the rate of profit may not fall temporarily for other reasons. But proceeding from the nature of the capitalist mode of production, it is thereby proved logical necessity that in its development the general average rate of surplus-value must express itself in a falling general rate of profit. Since the mass of the employed living labour is continually on the decline as compared to the mass of materialised labour set in motion by it, i.e., to the productively consumed means of production, it follows that the portion of living labour, unpaid and congealed in surplus-value, must also be continually on the decrease compared to the amount of value represented by the invested total capital. Since the ratio of the mass of surplus-value to the value of the invested total capital forms the rate of profit, this rate must constantly fall.

Even if the exploited mass of the working population were to remain constant, and only the length and intensity of the working-day were to increase, the mass of the invested capital would have to increase, since it would have to be greater in order to employ the same mass of labour under the old conditions of exploitation after the composition of capital changes.

Since the development of the productiveness and the correspondingly higher composition of capital sets in motion an ever-increasing quantity of means of production through a constantly decreasing quantity of labour, every aliquot part of the total product, i.e., every single commodity, or each particular lot of commodities in the total mass of products, absorbs less living labour, and also contains less materialised labour, both in the depreciation of the fixed capital applied and in the raw and auxiliary materials consumed. Hence every single commodity contains a smaller sum of labour materialised in means of production and of labour newly added during production. This causes the price of the individual commodity to fall. But the mass of profits contained in the individual commodities may nevertheless increase if the rate of the absolute or relative surplus-value grows. The commodity contains less newly added labour, but its unpaid portion grows in relation to its paid portion. However, this is the case only within certain limits. With the absolute amount of living labour newly incorporated in individual commodities decreasing enormously as production develops, the absolute mass of unpaid labour contained in them will likewise decrease, however much it may have grown as compared to the paid portion. The mass of profit on each individual commodity will shrink considerably with the development of the productiveness of labour, in spite of a growth in the rate of surplus-value. And this reduction, just as the fall in the rate of profit, is only delayed by the cheapening of the elements of constant capital and by the other circumstances set forth in the first part of this book, which increase the rate of profit at a given, or even falling, rate of surplus-value.

To add Marx also goes into counteracting the tendency of the rate of profit to fall here in chapter 14 one of them increasing the exploitation of labor. If you check out those chapters and I think chapter 15 to, Marx has examples in them, but in chapter 13 and 14 he tries to give examples.

Could that be because profit is declining while surplus value is actually increasing, although the surplus value is just going into the increasing cost of labor…?

Yes, to yer first insight, though I don’t understand yer second insight… usually rate of surplus value increases, by increasing surplus product, depressing variable capital (wages) or both

do you know where the rates of surplus value and profit differ, just to ask? (hint: wages vs total Capital)

they don’t talk as much about the overall rate of surplus value falling

The rate of surplus-value does not necessarily correlate with the rate of profit.

formula name s/v rate of surplus-value s/(c+v) rate of profit The reason the rate of profit tends to fall is because constant capital © tends to increase its fraction of the total capital — the ratio c/v increases. This results from technological development reducing labor inputs over time.

But the rate of surplus-value s/v doesn’t depend on constant capital at all. So if the rate of surplus-value tends to decrease, it can’t be because of a change in the fraction of constant capital.

The rate of profit and the rate of surplus-value express different things.

The rate of profit is what motivates capitalists and the capitalist economy in general. A capitalist invests money M in order to receive M’ > M at a later point. In developed capitalist society, this occurs with such regularity and uniformity that there emerges a “market rate” for this money growth, a singular rate of profit known to anyone who wishes to invest their money.

The rate of surplus-value — a category identified only through the chapter one analysis of value — is synonymous with rate of exploitation. It is a simple ratio of unpaid-to-paid labor, performed either by an individual worker or by the working class as a whole. In principle, this rate could stay fixed at 100% forever, and the rate of profit would decrease independently as c/v increases.

You explained it quite succinctly…

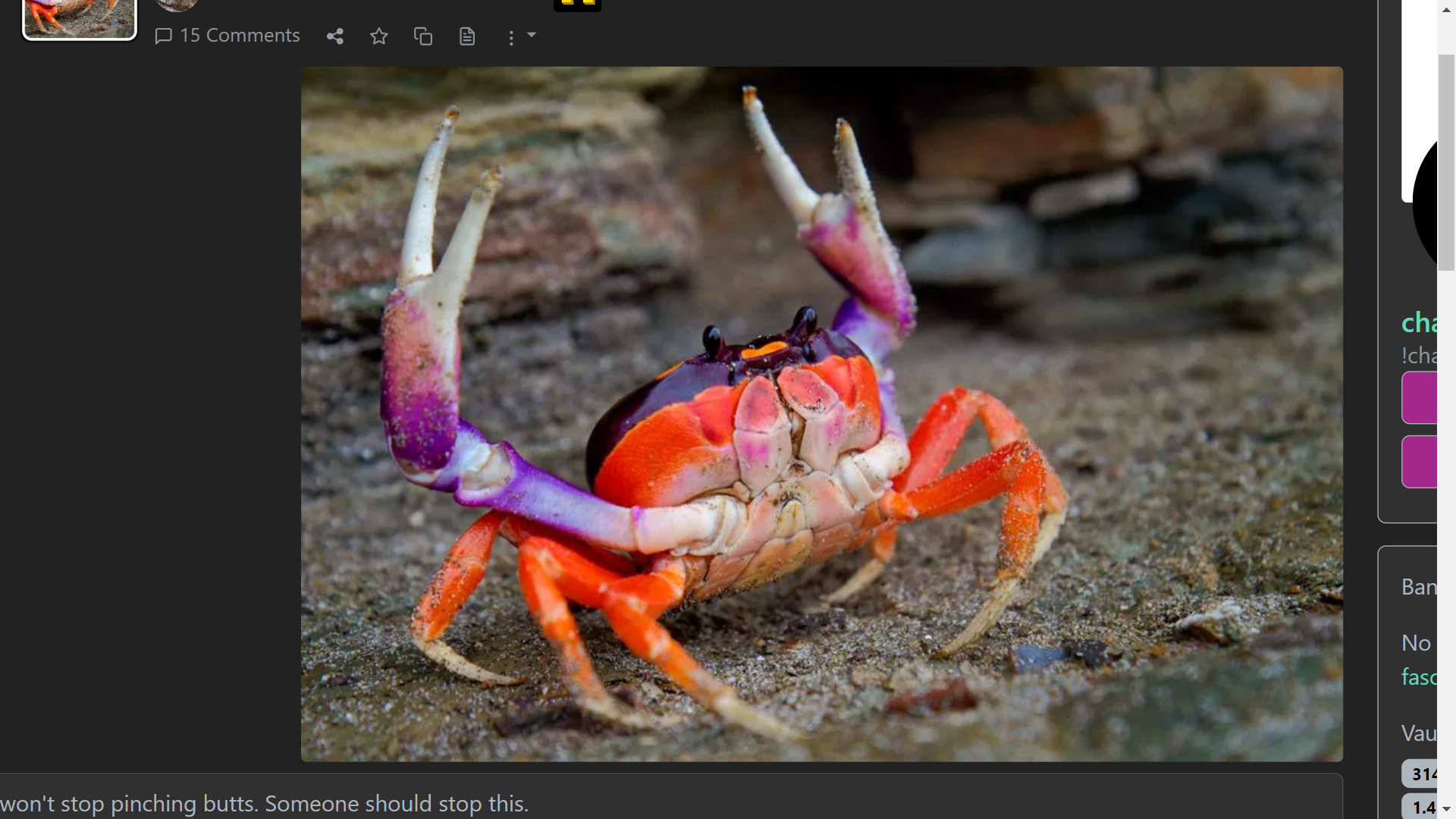

This image should explain (my understanding of) the difference between surplus value and profit.

Surplus value is the value of commodities produced beyond the equivalent value of commodities needed to produce a day of labor.

You can imagine a worker who could somehow teleport between jobs, spending exactly long enough in a bread factory to make their daily ration of bread, exactly long enough at a treatment plant to make their day’s water, exactly long enough at a clothes factory to make up the “fraction” of wear and tear on their clothing for the day, exactly long enough at a power plant to produce their day’s usage of electricity, etc…

If you add up all the time required to produce each of the commodites they need each day, then you would find the labor time required to produce one day of labor - the value of a day of labor. The special characteristic of labor as a commodity is that it produces value, so that while it takes X amount of value to produce a day of labor, that day of labor then produces X+Y amount of value. The extra value produced, Y, is called the surplus value.

Appropriation of surplus value is the basis of capitalism, but not all the surplus value is necessarily appropriated - unless the worker is being paid an absolute minimum subsistence wage (which, to be sure, the capitalists are always trying to force them down to) then they will also receive some portion of their own surplus value that they were forced to produce.

But the bulk of the surplus value goes to the capitalist, in the form of the commodities produced over the course of the day of labor. This is then eaten away at by the cost of materials and upkeep for the tools and machinery (as required for production of the specific commodity turned out by their factory) and then modulated by the price of their specific commodity on the market as affected by supply and demand at the particular moment they try to sell it, to result in the final profit.

The capitalists are thus always trying to increase both their share of the surplus value relative to the worker’s share, and the absolute amount of surplus value produced in a working day - the simplest tools of which are, respectively, paying workers less per hour, and making them work more hours - in order to make an even greater quantity of products while paying out the same wages.

However, this runs into the problem that for every additional unit of commodity produced without paying additional wages, there is relatively less money in the market to buy your additional commodity. So, with every capitalist trying to create more surplus value without paying more wages, the laws of supply and demand force the price of their commodities to decrease further and further until they can no longer sell them for a profit. This creates a crisis of overproduction, which happened continuously in every industrial economy throughout the 19th century (until the discovery that you can send your gunboats around the world to force open new markets and dispose of your excess commodities there) and even after that point recurred frequently, as described for instance in The Grapes of Wrath.

So the crucial thing to take away is, while surplus value is necessary for profit, at any time there is a particular ratio between them that the capitalists are working their absolute hardest to erode away until the whole system is so choked with commodities that they can no longer be sold - until the surplus value can no longer be realized as profit. The obvious inefficiency of this is why communist nations can post such staggering rates of industrial growth, as manufactured goods can be allocated based on rational central planning instead of having to go through the anarchy of the market - surplus value can be realized directly into increased industrial production.

The concept of “profit” is a weird thing. Its also a term that seems to have different meanings depending on context. Like, it absolutely won’t surprise me if there’s a “Marxian” definition of profit that doesn’t equate to a Business School 101 definition of profit that doesn’t equate to a Farmers Market vendor’s use of the term profit.

Until some quantity of capital is removed from a business, its not technically profit. But people will also view any value over the costs of selling something as profit, even if there are future costs that the current surplus could be used to to pay for.

So lets say that I have a small orchard and sell apples after the harvest. I’ve spent the year keeping track of expenses so I know how much “in the hole” I am. Harvest seasons comes around and I have apples to sell. If I compare sales revenue with my past expenses, for a while the revenue is less than my expenses. At some point, I hit the break even point where revenue and expenses are equal. If things are going decently, sales will continue until revenue will be greater than expenses.

From one perspective I didn’t make any profit at all, because I haven’t taken any of the revenue out of the “business”. From another perspective, I didn’t make profit until revenue exceeded the break even point (even though I didn’t remove capital). If I were to take money out of the business, spend it somewhere else, and find that my business had future expenses that coulda/shoulda been paid with the money that I took out of the business… “I, as the owner”, realized profit (by removing capital from the business) but the business didn’t make a profit (because the removed capital could have been used to continue funding business operations.)

So I guess this rambling is just a reminder to pay attention to the context that the term “profit” is being used as it will help to reduce confusion.

End of Volume 1 chapter 17:

[Ricardo] has not, any more than have the other economists, investigated surplus-value as such, i.e., independently of its particular forms, such as profit, rent, &c. He therefore confounds together the laws of the rate of surplus-value and the laws of the rate of profit. The rate of profit is, as we have already said, the ratio of the surplus-value to the total capital advanced; the rate of surplus-value is the ratio of the surplus-value to the variable part of that capital. Assume that a capital C of £500 is made up of raw material, instruments of labour, &c. © to the amount of £400; and of wages (v) to the amount of £100; and further, that the surplus-value (s) = £100. Then we have rate of surplus-value s/v = £100/£100 = 100%. But the rate of profit s/c = £100/£500 = 20%. It is, besides, obvious that the rate of profit may depend on circumstances that in no way affect the rate of surplus-value. I shall show in Book III. that, with a given rate of surplus-value, we may have any number of rates of profit, and that various rates of surplus-value may, under given conditions, express themselves in a single rate of profit.

Profit includes constant capital. Surplus value is an analytic category used to get behind profit and understand its true nature.

I’m curious what makes you think there must be a difference and why is it important.

If I remember, correctly, rate of profit seems to refer more to

surplus product / (means of production + wages)

not

surplus product / wages --> which is rate of surplus value

Yes. Capital wants to produce pure profit, to generate it out of thin air without any machinery or land — setting to zero the MoP part of that first equation.

Marx analyzing John Stuart Mill:

With regard to this wonderful illustration, we note first of all that, as a result of a discovery, corn is supposed to be produced without seeds (raw materials) and without fixed capital; that is, without raw materials and without tools, by means of mere manual labour, out of air, water and earth. This absurd presupposition contains nothing but the assumption that a product can be produced without constant capital, that is, simply by means of newly applied labour. In this case, what he set out to prove has of course been proved, namely, that profit and surplus-value are identical, and consequently that the rate of profit depends solely on the ratio of surplus labour to necessary labour. The difficulty arose precisely from the fact that the rate of surplus-value and the rate of profit are two different things because there exists a ratio of surplus-value to the constant part of capital—and this ratio we call the rate of profit. Thus if we assume constant capital to be zero, we solve the difficulty arising from the existence of constant capital by abstracting from the existence of this constant capital. Or we solve the difficulty by assuming that it does not exist. Pro batum est.

My understanding is that profit slides with supply and demand, you can sell commodities above or below their Value, but the surplus Value as a proportion of the Natural Value, ie the Price when supply and demand “cover each other,” remains the same regardless of the actual supply and demand.

Ie, a commodity with a natural value of 25 dollars, 10 of which coming from labor as surplus value, retains the 10 dollars of surplus value extraction no matter if the commodity is sold for 30 dollars or 20 dollars.

I haven’t yet read Capital though, only Wage Labor and Capital and Wages, Price and Profit, so if someone could correct or confirm what I have said that would be nice.

“All economists share the error of examining surplus-value not as such, in its pure form, but in the particular forms of profit and rent. What theoretical errors must necessarily arise from this will be shown […] in the analysis of the greatly changed form which surplus-value assumes as profit.”

— Marx’s opening statement to “Volume 4” of Capital, Theories of Surplus Value

There is a difference between profit and surplus-value. It can be summed up pretty much as follows:

- Surplus value is the general, abstract form of economic exploitation which enables a non-working ruling class. Profit is one concrete form taken by surplus-value.

- Profit includes constant capital. Surplus value does not.

You could say they are the same thing looked at from different points of view, or that it is surplus value while in production and turns into profit in circulation. They probably also have historical differences when looked at beyond the era of capitalism.

This would make the terms easier to think about, not sure if its the conventional use of the terms though…

Surplus value is unrealized profit. Revenue > than costs during a period of time

Profit is capital removed from the enterprise. [Total Revenue - Removed Revenue] During a Time Period = realized Profit

My understanding of it:

Surplus value = value workers produce in excess of what they need to live. So if I work 8 hours but only needed to work 3 in order to maintain my current standard of living, my surplus value is 5 hours of labor-time.

Profit = the net earnings of the capitalist through the act of production. The capitalist earns the surplus value produced by workers through exploitation, of course, but not only do they have to pay the workers’ wages, they also have to pay for constant capital, which is machinery, equipment, and other things needed for production besides labor.

So profit = surplus value generated - the cost of constant capital.

in managerial economics, “profit” is typically broken down into various slices, especially for the sole proprietor who might pay themselves out of “what’s left”, may even be the only employee, may have different debt types (operating loans vs infrastructure loans). so they talk about “returns” i.e.

Return to Labor/Management, and Capital: is the money left after you’ve paid your material and operating costs, but haven’t paid down the principal on any debt (after making minimum payments on their debt servicing) or yourself as manager/worker. this is how a lot of self employed, sole proprietor, single owner/operators keep books and conceptualize profits. it works, but it’s limited and can lead to issues if the income is variable and doesn’t really do much for making decisions.

better practice is to bake your salary (as manager/employee) into the budget and maybe even come up with a plan to pay down debts faster. paying yourself a fixed salary allows one to conceptualize what their hourly rate is and start analyzing the decisions they make about clients they take on, how to spend their time, and definitely what improvements to make to your infrastructure, etc. obviously numbers don’t capture drudgery or enjoyment, but they do matter in knowing what would squeeze you (and be worth cutting your own salary for a while) and what might sink you.

there’s another distinction of “accounting profitability” vs “economic profitability”. accounting profitability is money leftover after you do your thing in a given period of time. economic profitability is that same amount minus what you would have netted doing something else (ie opportunity cost lost by running your business a certain way, or not working for someone else).

there aren’t always analogues of these concepts to marxian economics because managerial economics are micro and Marx is towards the macro end, but I strongly believe understanding managerial economics (which can be learned fairly easily in like 1 class in college) can make one a better marxian analyst of how an organization can be more equitably organized, not to mention it helps a lot if you want to do your own thing and avoid exploiting yourself unnecessarily.

I’ve always equated them. Guess I need to read more theory.