Most people believe that as house prices rise, this is good for home-owners. It seems obvious, that if you own something, and the price of that this rises, you become richer. You have made a profit.

But it is not true.

I cover the case where all houses increase uniformly. For example x → px where p>1 or x → x+Δx where Δx>0. Conversely if the price of your house is increasing while the prices of other houses are decreasing, you can indeed make a profit, and benefit from the price change.

When you buy something, then sell it for a higher price, you make a profit. But when you sell a house, you normally selling it to buy a most expensive house. So the profit is sunk into another asset. You can never obtain your profit in cash.

If the price of your house rises while you are living in it, then you sell it to buy a more expensive house (the usual case), then the price of the new house has also risen by at least as much. You would have been as well (or better) off if house prices has remained stable.

The people who can make money from housing inflation are people owning multiple houses, people who downsize, people who become homeless, the estates of people who die and have no children. Investment funds are the big beneficiary of housing inflation, because they are free to buy and sell all of their assets.

In fact if house prices were kept stable by progressive government policy (for example continuous adjustment of to mortgage term limits, loan-to-value limits, or property taxes, similar to what central banks do with interest rates) then investment funds would sell their housing stock in favour of more profitable assets. This would be an even greater benefit to society (including home owners) from stable house prices.

The biggest loser is of course first time buyers.

There are other effects. You could argue that governments benefit from increased taxes. Estate agents and solicitors benefit from higher fees.

The other winner is banks. The profit a bank makes from a mortgage is directly proportional to the price of the house. So banks benefit not from price changes but from maximising prices. (Banks benefit even more from high interest rates and long mortgage terms, at the expense of home-owners. But these factors also influence house-prices. So the above generally true but not a simple relationship).

The above is not a unique feature of the housing market. It is an example of inflation. As assets increase uniformly in value through inflation, it seems like asset holders are making profit. When you sell the asset you make more money, but money is useless unless you use it to buy another asset. The price of the new asset has also increased by the same amount. So the holder reaps no benefit from the increase. That’s why economists say that the value of the asset remained the same but the value of money decreased.

So this result for the case of housing is not surprising. It is an example of inflation at work.

The main effect of housing inflation is a transfer of purchasing power (and in the long run, of money) from people buying and selling houses to banks and investment funds.

I cover the case where all houses increase uniformly.

That’s a very questionable assumption however. While a general increase is possible, uniformity hardly ever exists in a real life scenario.

But when you sell a house, you normally selling it to buy a most expensive house.

Very bold assumption yet again. Many people buy a house for life, and sell it when they are retiring, live of their equity and rent or buy for a fraction of the money in a lower cost of living area.

I’m not saying your observations are wrong, rather simplified to the point of being unrealistic.

Yeah if expect a lot of the time you are selling once you’ve held an asset for a long time. You are looking to downsize. Family has grown up and now needs money to afford to buy in stupid housing market.

Only people who benefit from house prices rising are those using homes as collateral and real estate. Both I’d prefer not exist.

Of course in a democracy we could create laws to limit that. But that’s a subject for a different day.

They are not assumptions. They are constraints. I’m limiting the scope of the argument to make it simpler to explain.

The non-uniform changes could be discussed in a different article. Then the real changes are the sum of the uniform and the non-uniform. That would be a rigorous treatment. Here I’m instead just explaining the general principle.

Many people buy a house for life, and sell it when they are retiring, live of their equity and rent or buy for a fraction of the money in a lower cost of living area.

This is an interesting idea. The people who do this, who eventually sell and live in a nursing home or rent, they profit from an inflating housing market… But if they have children who then want to buy houses, they still lose, because their estate is devalued by inflation.

The overall assumption is valid though, that a person needs a place to live… he did address downsizing and the like :)

Reverse mortgage is a mechanism to pull that equity that wasn’t mentioned anywhere yet, but it’s fairly easily arguable that it’s still what they’re describing, a mechanism by which equity gets pulled from the average joe and transfers to the banks and investors…

I don’t think his overall point is reduced much by the assumptions personally.

I think the elephant in the room is the fact that the people getting raped by all of it are the ones who rent and can’t actually buy their own property though. Homeownership isn’t the fast track to riches it’s assumed/declared to be, but if you’re not a homeowner, you’re digging a hole financially that’s hard to get out of. Buying a property essentially puts you at the ground floor, so to speak.

I agree. I think that’s already widely understood though.

First, the number of people who downsize is not an insignificant amount. And as people age, many also turn to rental markets where they no longer have to maintain their home themselves.

Second, prices don’t rise uniformly. People from more expensive areas can relocate.

Third, don’t overlook the benefits of rising equity giving access to cheaper credit.

And the bottom line is, when housing prices rise, all prices rise in the market, including rentals. So even if there is little benefit, it is still better to have an asset that is also increasing in price rather than just having to pay more. Also, with fixed rate mortgages, you effectively get to lock in your housing price rather than getting repriced in the market.

people who downsize

They do really profit from inflation. But if they have children who then want to buy houses, overall the family loses just the same. Only investors win in the end.

prices don’t rise uniformly

It is true. I just limit the scope of the argument to uniform changes, to make it easier to explain. Including the effects of non-uniformity would make it much longer.

access to cheaper credit

You mean how it is cheaper to remortgage than to get a normal loan? This is something I did not consider. Does that change anything for the overall argument?

still better to have an asset that is also increasing in price

Yes true.

There are options like a home equity line of credit (HELOC) or a cash out refinance that offered far better better rates than credit cards, personal loans, or other unsecured credit lines. But is is only accessible with significant equity. Such can fund home improvements, used cars, or other big ticket purchases.

If you’re upsizing, house price decreases are in your favour as the prices are getting closer together

If you’re downsizing, then increases are in your favour as they are inflating further apart

Yes. But consider the whole cycle. You must buy before you can upsize/downsize. And if you have children who need to upsize again. The homeowner always loses from inflation in the end and the investors always win.

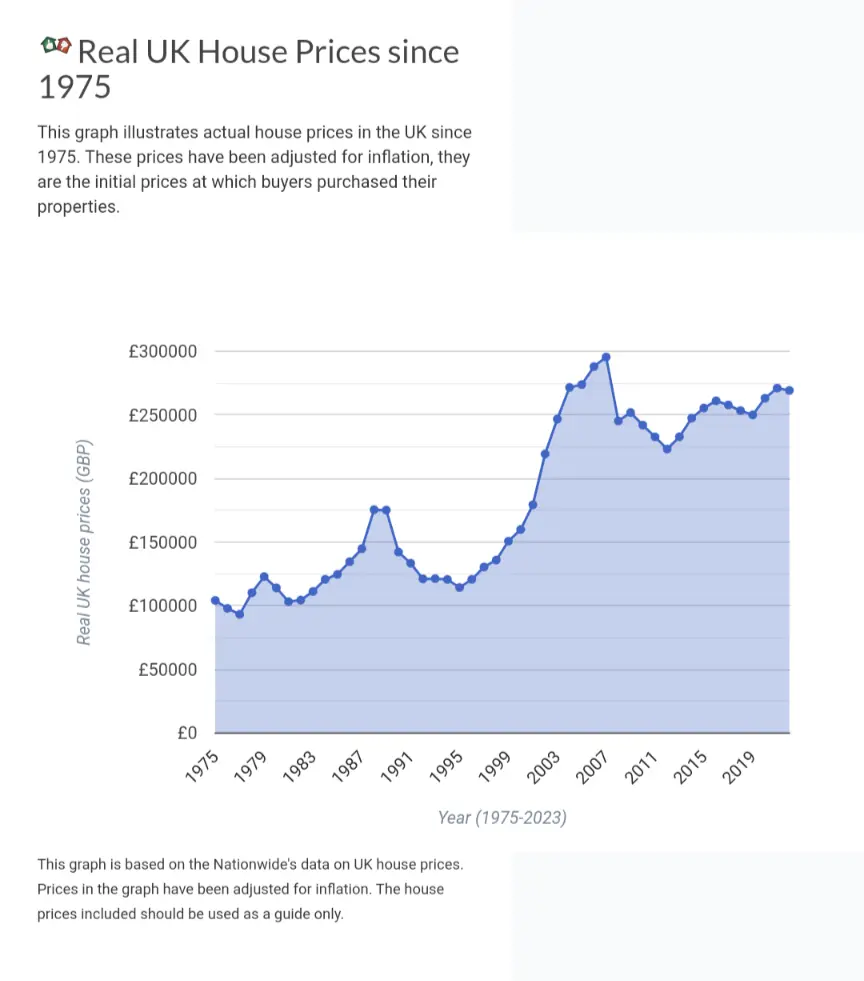

Homeowners do not lose from inflation, here’s inflation adjusted numbers

When I talk about inflation here, I am referring exclusively to inflation in house prices. The effect of inflation in other markets is not covered here.

So how are homeowners harmed by house price inflation? That’s wealth creation when compared to renting, which is wealth destruction.

This process of investing your saved money to grow your wealth by choosing investments that align with your financial goals is called wealth creation.

I guess it is. I don’t cover I’d this article the financial difference between buying and renting, because most people already understand that. Buying is usually better.

Housing price rises are bad for home-owners

Is your title, this is not true.

Some homeowners improve housing and then move, on a rising market this is beneficial to the homeowner

On a falling market prices get closer together so less leverage is required for extra space

Buying and holding is beneficial as long term houses will rise and the price paid will be reduced by inflation.

Home ownership can be beneficial in most market scenarios, and the longer the ownership the more beneficial.

It’s possible to use rising home values to your advantage without selling, by borrowing against that value to start a business, purchase a second property, etc.

Leverage is obviously risky, but you shouldn’t leave this out in your analysis.

There are other advantages too, like the fact that home ownership can act as a good counter against inflation, since hard assets like houses tend to be inflation-proof. Or the value of a home in estate planning, since (here in Canada anyway) when you die you don’t have to pay capital gains on a home you pass to your heirs.

borrowing against that value

Yes I guess so.

counter against inflation, estate planning

I think you still lose. You can only realise the benefits by selling and being homeless. Your estate has higher value which is wiped out by your children buying houses at inflated prices.

Unless you’re about to sell, having a high home price is terrible. It means higher property tax and higher homeowner’s insurance premiums. Plus, as you pointed out, if you have to turn around and buy another house at an inflated price, you’re no better off.