PREFACE – A quick little short squeeze

SOME OF THE GREAT DD AND ITS CONNECTION TO GAMESTOP AND THE STOCK MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- What is a share and where is it held?

- How many entities technically have access to a share?

- Where are the shares traded and how is the price derived?

- How regular people think price discovery works and how it actually works?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- Where are the shares traded and how is the price derived?

Economic value is defined by the exchange (or OTC) where the share is traded. The market capitalization of a company is defined by the public exchange where the security is mainly listed, e.g. NYSE or NASDAQ.

For some security this exchange will have not the most volume, which is kind of odd isn’t it? Also the security might trade on foreign exchanges or in dark pools, the latter often deriving the price from public exchanges (https://www.investopedia.com/terms/d/dark-pool.asp), while having far greater volume than the public exchange.

Those exchanges use an order book to match bids for supply and demand. Watching the the Wallstreet Conspiracy (https://www.youtube.com/watch?v=26_IcexvePA) or The Problem (https://www.theproblem.com/episode-5-the-problem-with-the-stock-market/) it’s always about scraping pennies on the dollar. So doesn’t really feel that bad, does it?

Let’s recap how regular people think price discovery is working and see how price discovery it’s actually working with all we learned during the journey.

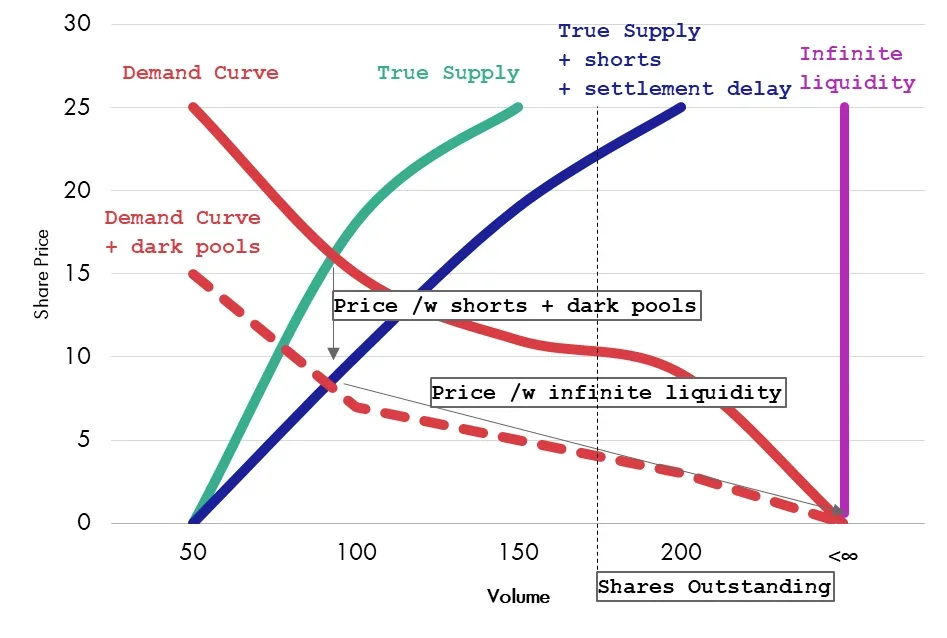

- a How regular people think price discovery works?

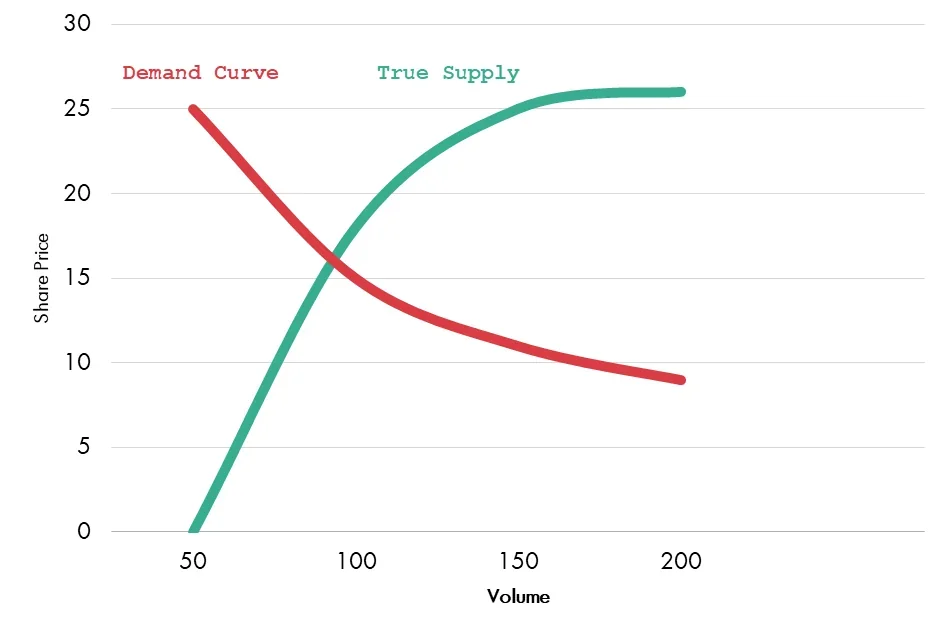

Supply & Demand sets the Price. You can think of this as an orderbook, so for a price of $25 there are buy orders for 50 shares, while for a price of roughly $11 there are buy orders for 150 shares.At the same time for $25 there are sell orders for 150 shares and at ~$0 only 50 shares are paper handed. The intersection of those curves is than what defines the market price which is roughly $15 with a volume of roughly 100 shares exchanged hands.

Sounds easy right? And would look like this:

Price is where Supply and Demand meet, 𝑄𝐷(𝑃)=𝑄𝑆(𝑃) where Q is quantity of D(emand) and S(upply) at a certain (P)rice (see: https://www.core-econ.org/the-economy/v1/book/text/leibniz-08-04-02.html)

Price is where Supply and Demand meet, 𝑄𝐷(𝑃)=𝑄𝑆(𝑃) where Q is quantity of D(emand) and S(upply) at a certain (P)rice (see: https://www.core-econ.org/the-economy/v1/book/text/leibniz-08-04-02.html)

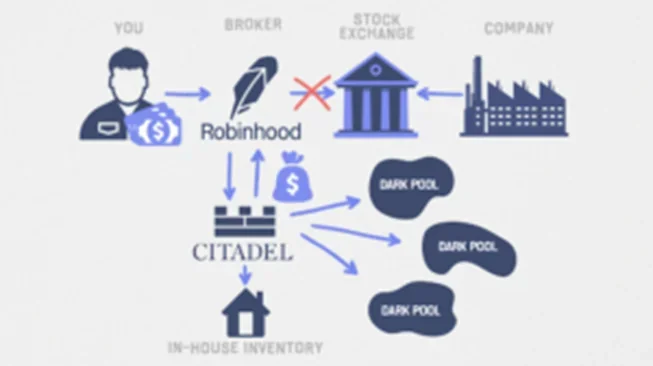

Thanks to a young boy from Bulgaria (Vlad Tenev, https://www.youtube.com/live/RfEuNHVPc_k?t=1305) GME investors soon learned about Payment for Order Flow, which would route orders to wherever the counterparty, mainly Citadel and Virtu in our case, wants. The Problem with Jon Steward (https://www.theproblem.com/episode-5-the-problem-with-the-stock-market/what-is-the-stock-market) and also the movie Gaming Wallstreet (https://www.imdb.com/title/tt18332840/) brought the concept on the big screen.

The Problem states that this scheme is to make pennies off of every transaction processed. However, Dark Pools were literally defined to do large trades without price adverse effects on the price [https://www.investopedia.com/articles/markets/050614/introduction-dark-pools.asp]. Some of them use the past price of lit exchanges (https://www.investopedia.com/terms/d/dark-pool.asp), where individual investors trades barely go to. Rereading some old DD it feels like there are some logical flaws in the early DDs. Like this post claiming “I don’t believe you can suppress the price of a stock through manipulation that only involves dark pools or off-exchange trading, as it is all publicly reported.” (https://www.reddit.com/r/Superstonk/comments/o70lid/dark_pools_price_discovery_and_short/). But I rather agree with the logical deduction in the comment (https://www.reddit.com/r/Superstonk/comments/o70lid/comment/h2w36ex/?utm_source=reddit&utm_medium=web2x&context=3).

Price is a function of supply and demand (like shown above). If you now print several different graphs instead of one and spread demand over them the individual demand is lower, while as a big market maker supply is not a problem even without naked shorts. So naturally the price will be lower when having several exchanges with lower demand but high supply (sponsored by the liquidity fairy). As example, let’s take lemonade stalls. Supply of lemonade is ample. So imagine, there is just one stall and everyday there is a huuuge queue (high demand) in comparison to you having one stall but there are like 10 more lemonade stalls around you and the queue would spread equally. In which scenario would it be easier to raise the price of lemonade? Easy, isn’t it?

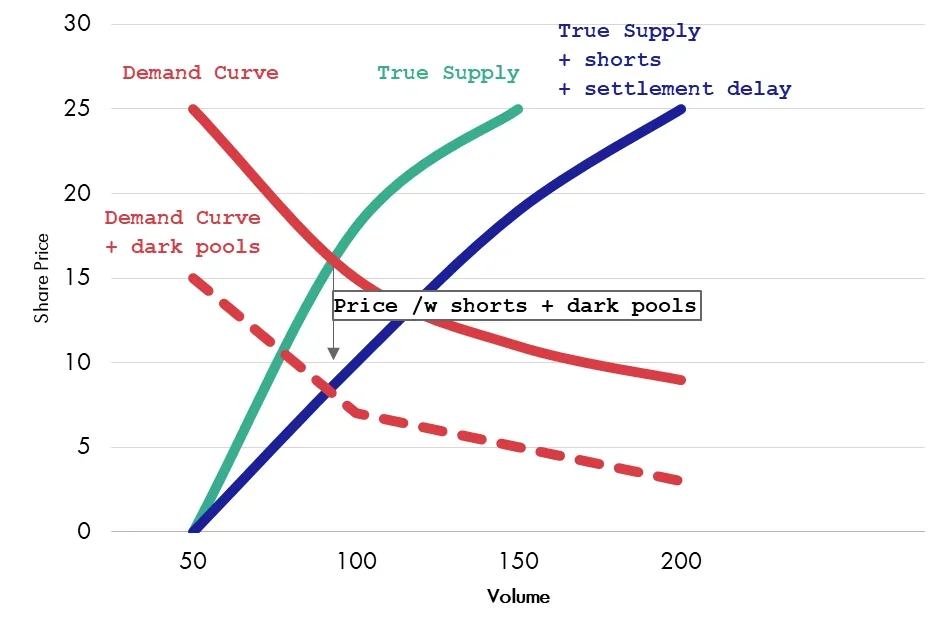

Further there are settlement delays (T+2 at least) and shorting which allow broker-dealer and market makers to temporarily inflate supply and thus lower the price. The graph would change to the following:

Changed equation: Price is where increased Supply (by shorts and settlement delay -> QSi) and reduced Demand (by routing -> QDr) meet, 𝑄𝐷r(𝑃)=𝑄𝑆i(𝑃)

Changed equation: Price is where increased Supply (by shorts and settlement delay -> QSi) and reduced Demand (by routing -> QDr) meet, 𝑄𝐷r(𝑃)=𝑄𝑆i(𝑃)

Wow we just lowered the price of the shares and also the market cap of a company.

Interestingly through the GameStop sneeze saga the size of the trades handled by dark pools shrank (https://www.reddit.com/r/Superstonk/comments/mx4j9p/dark_pool_dd_summary_and_a_quick_update_on_all/) leading to the theory of retail orders having no more influence on the share price.

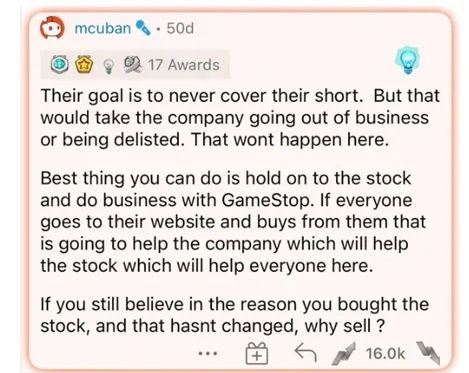

Even if synthetic shares are mentioned here and then, even on The Problem with Jon Steward, it’s almost never clearly put like Mark Cuban put it “[t]heir goal is to never [close] their short”.

I didn’t understand it when he said it, but its as simple as that: someone sells shares, collects 100% of the money and doesn’t actually deliver the share, forever.

So, if you want to cellar box a company somewhen even temporarily inflated supply would not be enough to reach a certain price point. “Finance professor (not me) mathematically proves that it’s impossible to short a stock to zero without naked shorting at least as many shares as there are outstanding, doubling the float in the process” (https://www.reddit.com/r/Superstonk/comments/nw8281/math_black_magic_vol_1_why_it_is_mathematically/ ).

Everything changes if supply can be inflated indefinitely. And naked shorts are just one way, finra often fines broker-dealers for wrongly labelling shorts as long [see Citadel has no clothes], also there is perpetual rolling and many more (see https://www.petepetit.com/mimedx/downloads/Counterfeiting-Stock.pdf). Synthetic shares are additional to the outstanding shares, meaning shares that should not exist.

- b How is the price actually discovered?

Adding synthetic shares the Price is now where already reduced Demand (by routing -> QDr) meets infinite Supply (QS∞), 𝑄𝐷r(𝑃)=𝑄𝑆∞(𝑃), which obviously is at some point ~0, or should we say finally cellar boxed.

Imagine MOASS starts, Tomorrow was Today, in which of the above systems would you rather want to be?

What are implications of “Supply & Demand” being actually “(routed to lit market) Demand & (synthetic) Supply”?

- The seller of a synthetic share receives 100% of the cash but giving 0% of additional value. (The buyer receives some value still, e.g. the economic value and maybe partial voting rights)

- Derivatives are tied (mostly leveraged) to the price of the underlying, so little swings in the price can mean huge swings for derivatives. (if the price moves to much from the perceived fair price and investors are willing to invest/divest huge swings are not possible w/o moving the perceived fair price or buying power)

- The company loses market capitalization and thus value which credit score is tied to but also suppliers will look cautiously at the market cap and probably revise their payment terms (e.g. upfront payment instead of late payments).

- Cellar boxing and bankruptcy jackpot become possible only with naked shorts.

- …

In 2004 blurring wrote “[t]hese massive naked short positions need to be looked upon as huge assets that need to be developed.” (https://investorshub.advfn.com/boards/read_msg.aspx?message_id=2543759). So what are the steps to do so?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

A massive short squeeze may not happen with GME under current market structure. Too many entities have access to shares in a way that the supply/demand relationship can always be manipulated through a nearly endless number of tactics including corrupt exchanges to suppress true price discovery. The main way an individual investor can change the current situation is by limiting access to their shares to exclusively themselves and that’s through the DRS system.

The second part beside exclusive ownership is something we cannot do ourselves easily. It’s an uncorrupt exchanges like tzero or loopring doing the absolute majority of the trades.

Only with those two pieces in place a large short squeeze may begin to unfold. The foundation of that happening is due to large short positions that exist as a hidden asset. The asset exists, but it’s hidden and therefore isn’t reflected in current market price. It is only through the extraction of this hidden asset that it will contribute to fair market price for the stock.

Thank you jersan! I 90% agree with your comment. From the outside it looks like an unprofitable business, though sitting on a pile of cash only offering lofty promises. Once GME is profitable it will be easier to onboard new investors and also encourage old investors.

To the “explode” part rather want to stress that another main point of my post is: DRS is not enough. Not enough for what? Like I wrote in my post about price elasticity (https://lemmy.whynotdrs.org/post/206100 or https://www.reddit.com/r/whydrs/comments/16ijwv0/tales_of_the_death_of_the_liquidity_fairy_price/) I think there are two levels:

With the current system of stock market exchanges no matter what the company does, it is very unlikely we see level 2. The price might be adjusted for Level 1, but shorts won’t close. They rather will hedge and make even more money with derivatives.

If you think otherwise, try to dig into the “Tesla shortsqueeze” and check who actually lost, which hedge fund had to be closed because of the closing of naked shorts.