- cross-posted to:

- worldnews

- green@lemmy.ml

- cross-posted to:

- worldnews

- green@lemmy.ml

In there a paywall I’m not seeing, or is the “article” only two sentences long?

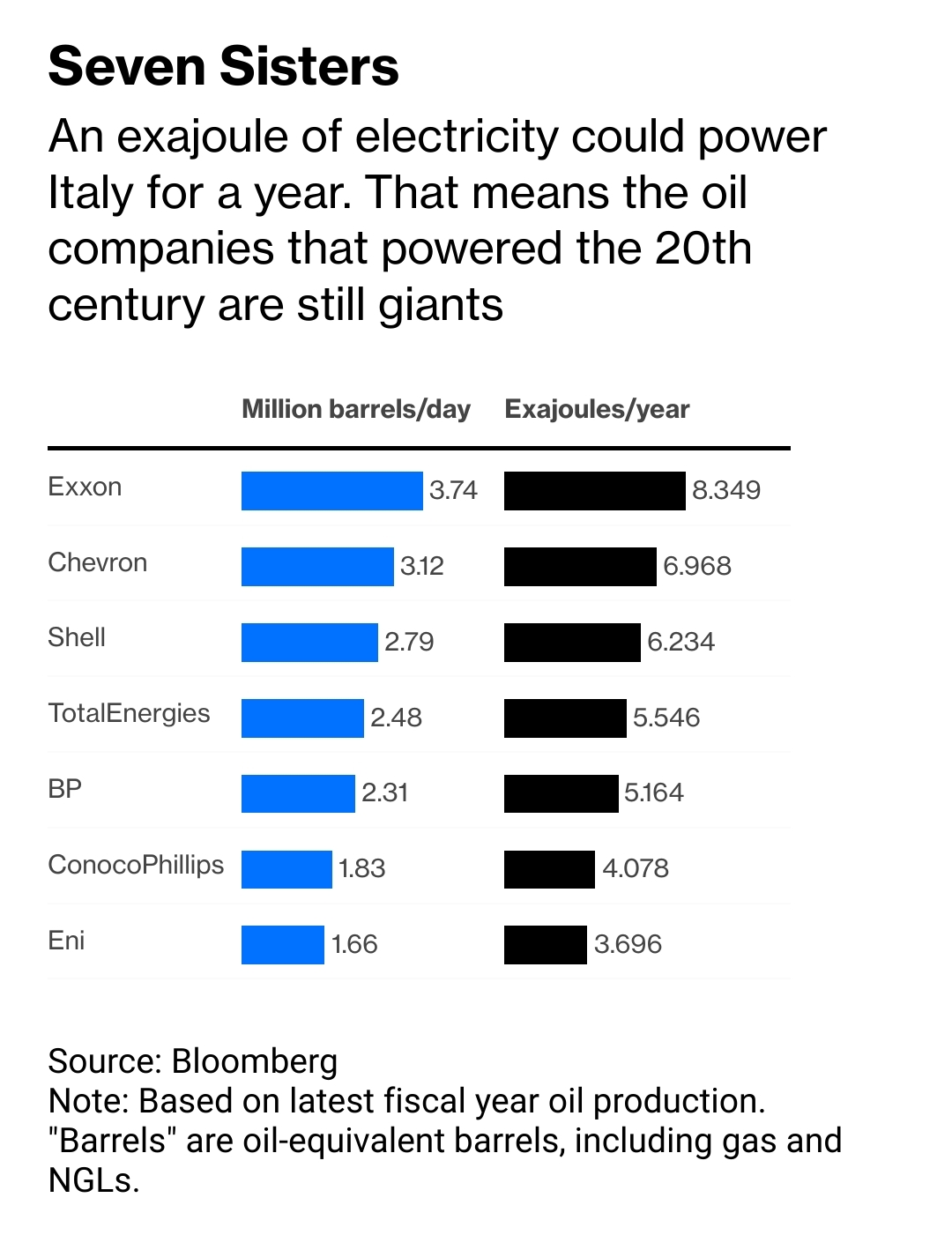

You’ve heard of Exxon Mobil Corp., Chevron Corp., Shell Plc, BP Plc, TotalEnergies Se, ConocoPhillips and Eni SpA?

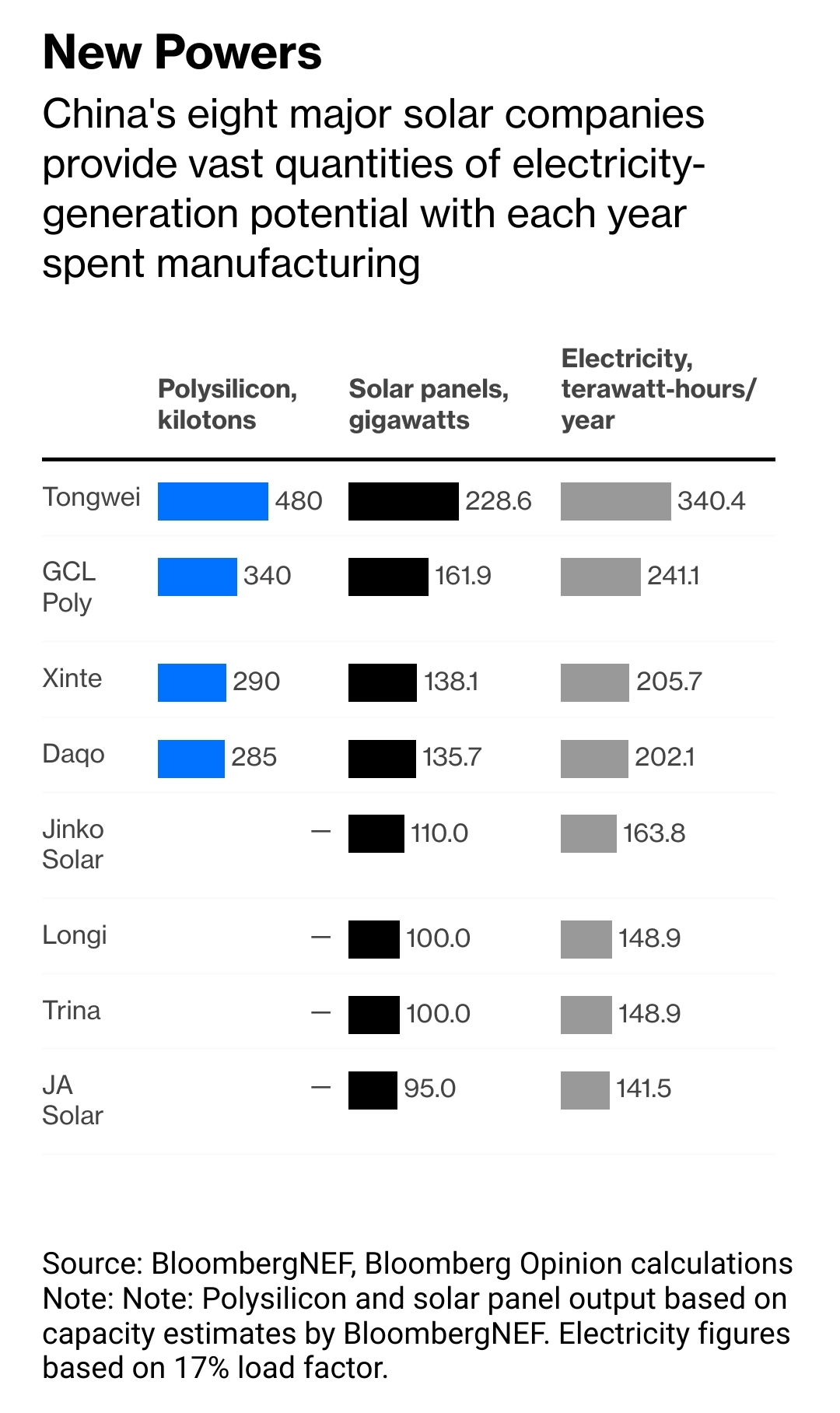

How about Tongwei Co., GCL Technology Holdings Ltd., Xinte Energy Co., Longi Green Energy Technology Co., Trina Solar Co., JA Solar Technology Co., and Jinko Solar Co.?

If the former names are familiar giants and the latter obscure, you might want to rethink how you look at the companies that provide the world with energy. On a reasonable accounting of things, the latter are just as significant — if not more so — than the powerhouses of petroleum.

That’s a remarkable shift. Around the middle of the 20th century, the predecessors of the major international oil companies attained such power that they were nicknamed the Seven Sisters, a group of energy producers with such global scope and influence that they could make or break governments. It took a wave of nationalizations and the 1973 oil crisis to end that model. A further disruption is now waiting in the wings, thanks to the unstoppable rise of China’s solar power sector.

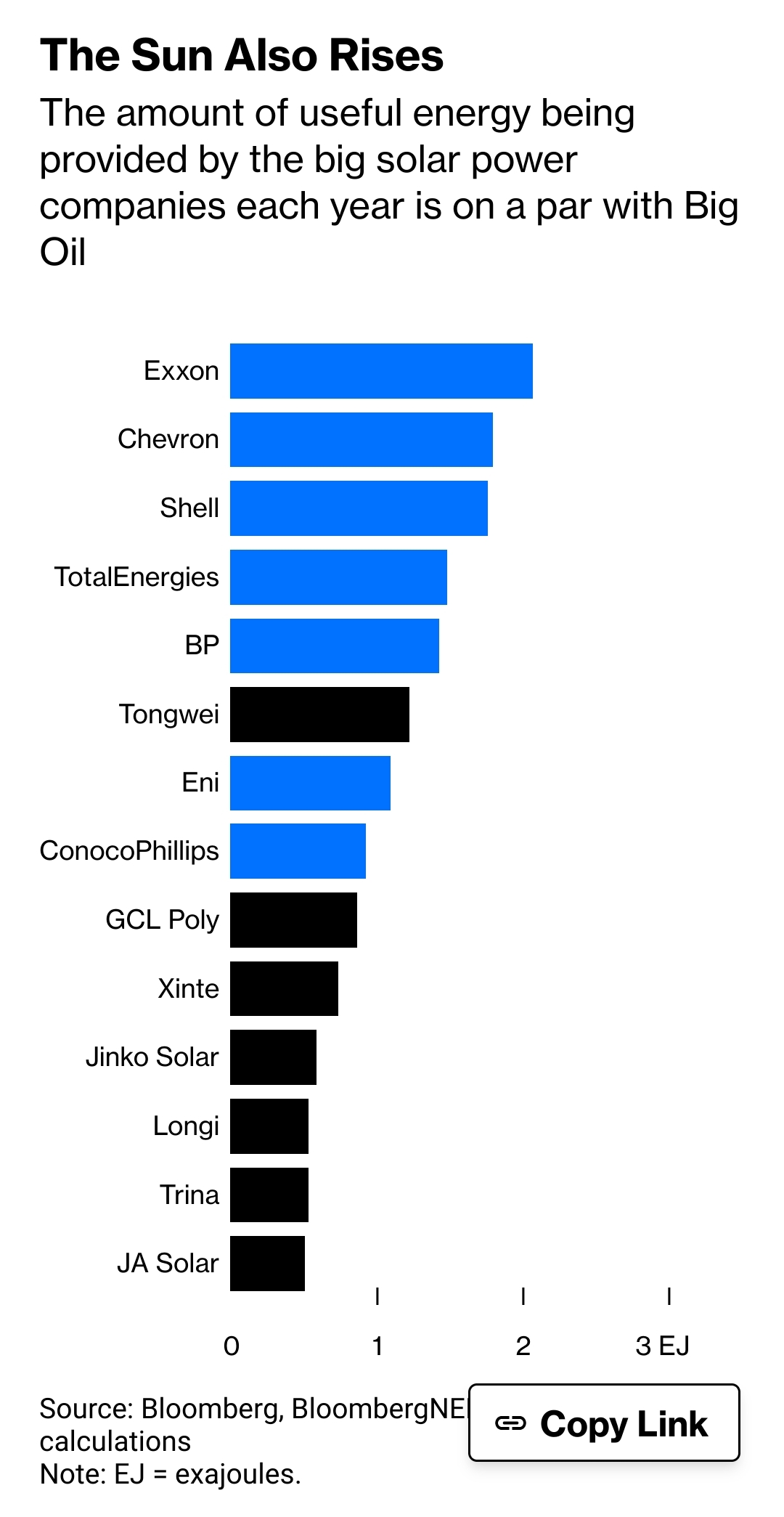

The best way to think about this is to consider what oil companies ultimately provide the world. It’s not really crude or natural gas, but the vital ingredient locked up in the chemical bonds of those hydrocarbons: energy.[1] The manufacturers of solar equipment, similarly, aren’t in the final analysis providing us with panels of silicon and glass, but machines that can harvest power from the sun. The activities of each group of companies provide a fresh flow of useful energy to the world every year. And by many measures, the solar companies have already overtaken Big Oil.

To see how, you can start by converting the barrels of crude and cubic meters of gas produced by the big petroleum companies into a measure of energy — exajoules. An exajoule of electricity would be able to power Australia, Italy or Taiwan for a year. And the big oil companies are making a lot of it: About 8.3 EJ annually for ExxonMobil and 6.2 EJ at Shell.

The vast majority of that is wasted, however. Only about a fifth of the chemical energy in freshly pumped crude ends up being turned into kinetic energy moving cars and trucks, because oil refineries and vehicle engines fritter most of it away as useless heat and noise.[2] Gas turbines are a bit more efficient at turning methane into power, but still end up operating at about one-third efficiency once you account for losses from gas well to electrical socket. At a rough estimate, only about a quarter of the energy coming out of an oil company’s wells gets turned into useful power.

We can do a similar transformation with solar. Companies such as Tongwei, GCL or Xinte that produce the polysilicon raw material for solar panels measure their output capacity in metric tons per year. It’s a simple process to convert that into gigawatts of the solar cells made by Longi, Jinko and the like, and ultimately into the exajoules that the resulting panels will generate[3].

Put the two side by side, and the result is striking. The biggest polysilicon producers right now can go head-to-head with some of the biggest oil companies such as BP, Eni and ConocoPhillips — and panel makers** **aren’t far behind. Should Tongwei go ahead with plans announced in December to build a 400,000 ton polysilicon plant in Inner Mongolia, nearly doubling its current output, it might overtake even ExxonMobil:

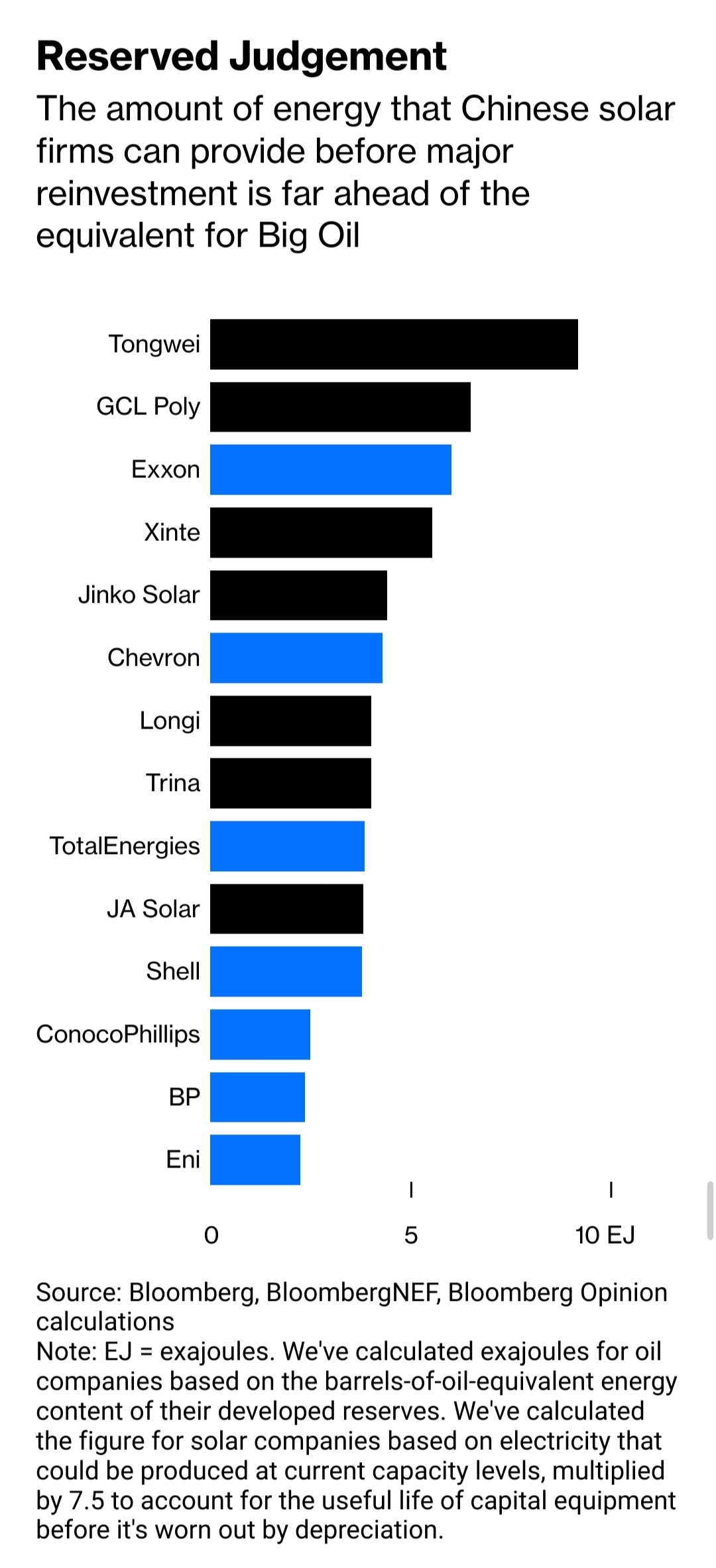

That still understates things. An oil company is ultimately developing reserves of petroleum that can keep producing for a decade or so into the future. A manufacturer, similarly, is building a factory that can churn out similar volumes year in, year out, until the equipment is worn out or obsolete.

If you consider what each group of companies can produce without major additional investments — comparing the volumes in oil firms’ geological reserves to what solar companies will be able to produce before depreciation wears out their plant — clean power moves clearly into the lead:

That’s still forgetting one more crucial factor. A solar panel sold by Longi in 2024 will be generating electricity for decades. Most carry 25-year warranties. Oil and gas sold this year, however, will almost all be used up in a matter of months. If you look at the long-term flow of energy into the global economy that’s crystallized with each solar cell produced, it’s many times what’s being provided by Big Oil:

Any comparison between oil and solar can be criticized for comparing apples with oranges — but if you buy apples and oranges you’ll often get a label telling you how many kilojoules they contain, and we should do doing the same for the exajoules provided by oil and solar businesses. Fruit, fuel and electricity all ultimately provide a measurable flow of energy.

Since the first industrial revolution raised coal-rich Britain, Germany and the US to dominance, and the rise of crude brought power and wealth to Russia and the Middle East while extending America’s global lead, the nations that controlled the headwaters of these energy flows have been the hegemons of each succeeding century.

Right now, seven Chinese companies have a bigger stake in the power source of the 21st century than the Seven Sisters of oil that dominated the 20th. If you want to understand the roots of the geopolitical angst driving Washington’s crackdown on China’s clean technology, it’s impossible to ignore that fact.

Footnotes

-

A small but crucial share of the world’s petroleum goes into non-energy products such as plastics, cosmetics, asphalt and lubricants. But the vast majority is ultimately burned for fuel.

-

Refineries do make use of waste heat to power some of their processes, but the same isn’t true of vehicle engines.

-

Solar panels don’t generate at night, and produce most of their power for a few hours around midday, so as with vehicle engines their actual power output is well below their maximum theoretical level. We’ve assumed a global figure for this so-called capacity factor of 17%, based on the median of the International Energy Agency’s estimates for China, the EU, India and the US.

-

deleted by creator

deleted by creator